NASDAQ futures are coming into Friday gap down after an overnight session featuring elevated range and volume. Price worked lower overnight and as we approach cash open prices are hovering just below the Thursday low.

On the economic calendar today we have the primary August reading of University of Michigan sentiment.

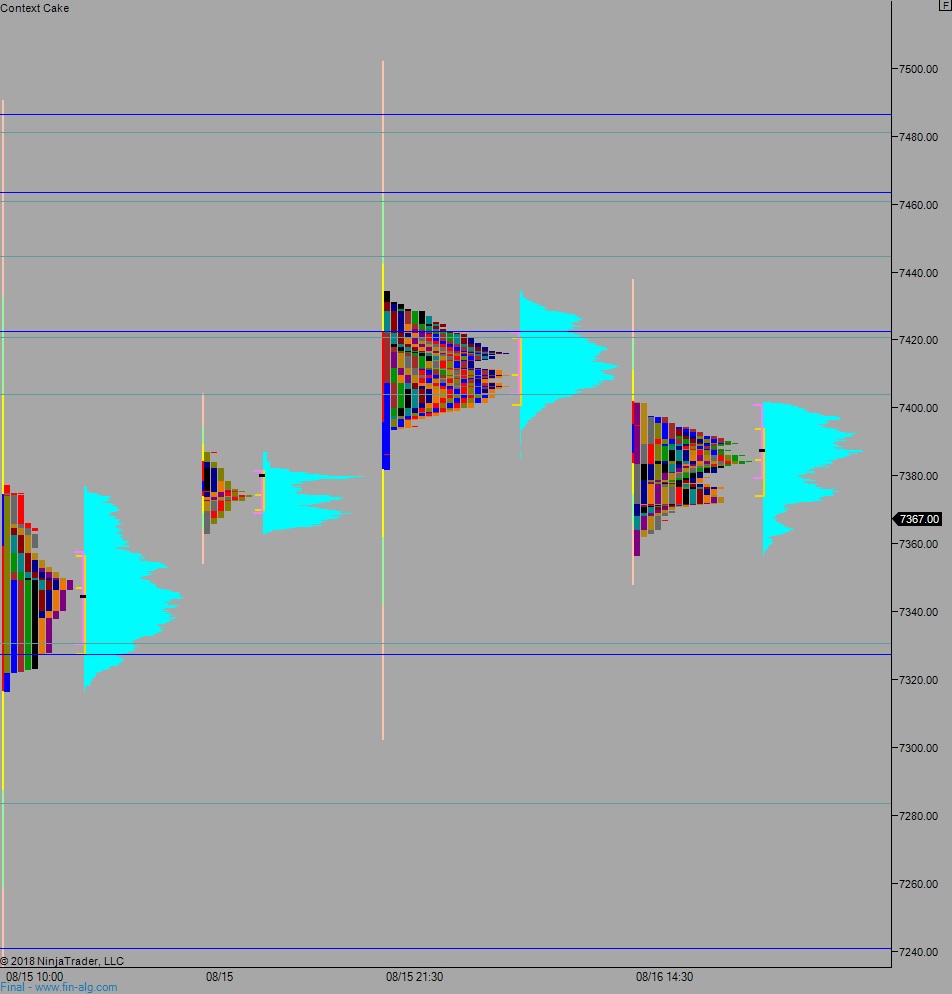

Yesterday we printed a neutral extreme down. The day began with a gap up and choppy morning that briefly went range extension up before lunchtime. Then the rest of the day was spent traversing the entire daily range to eventually push below IB low and go neutral. Price continued lower to close the overnight gap. We ended the day in the lower quadrant despite finding a responsive bid near the end of the day.

Heading into today my primary expectation is for sellers to gap-and-go lower, down through overnight low 7356.75 to target 7330.25 before two way trade ensues.

Hypo 2 stronger sellers take out the weekly low 7316.50 setting up a move to target 7300 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory and close the gap up to 7391. Buyers continue higher, up through overnight high 7397.75. Look for sellers at 7404.25 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: