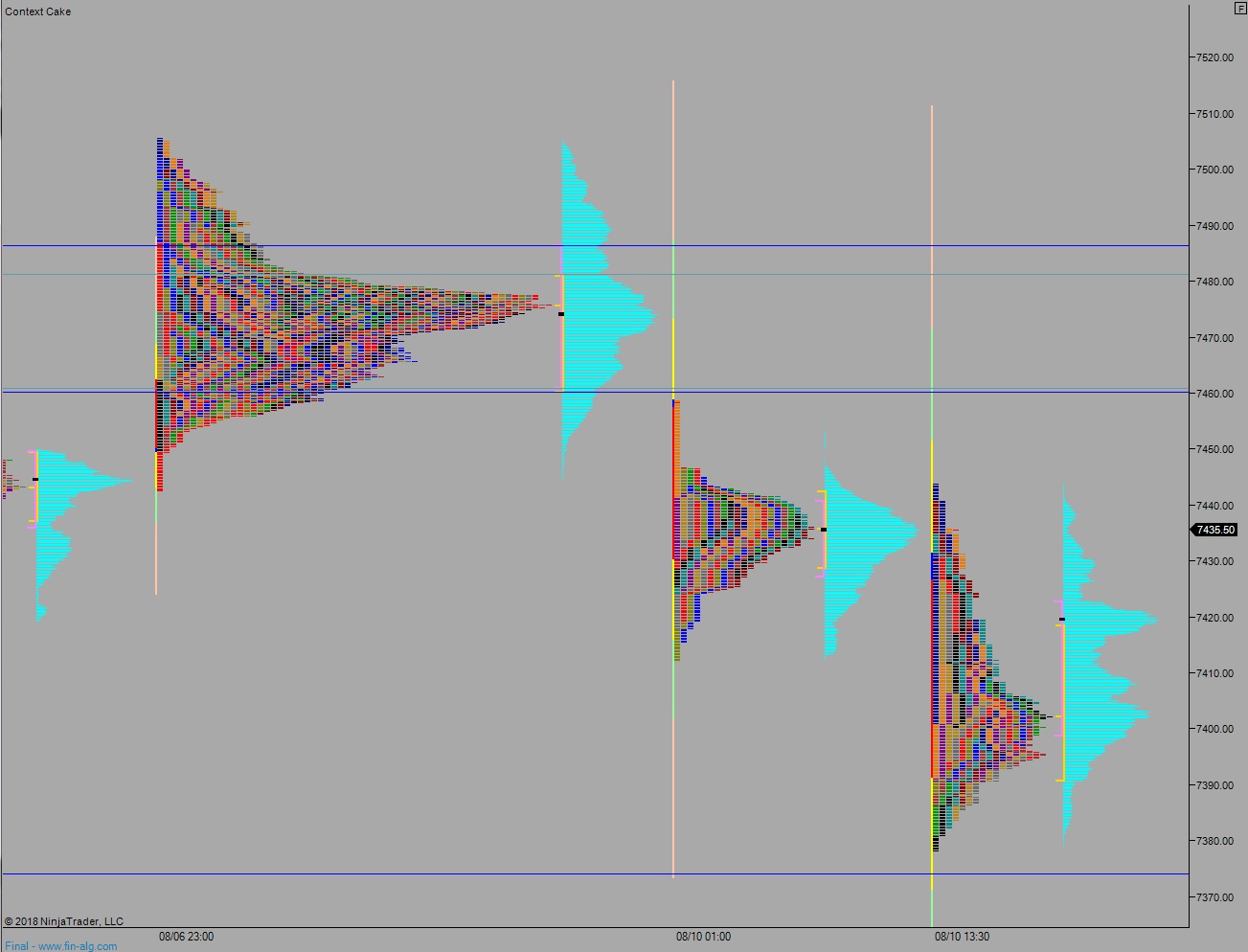

NASDAQ futures are coming into Monday flat after an overnight session featuring extreme range and volume. Price worked lower overnight, taking out last Friday’s low before a strong responsive bid came in. The market rallied more than 60 points off its low. As we approach cash open prices are hovering above last Friday’s midpoint.

On the economic calendar today we have a 3- and 6-month T-bill auction at 11:30am.

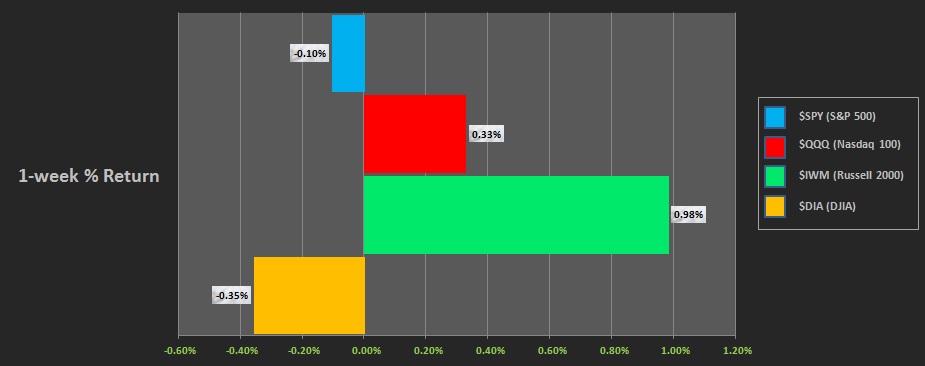

Last week we marked time. There was a rally Monday-Thursday then we gave it back Friday. The Russell demonstrated divergent strength. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down after coming into the day with a gap down. Sellers spent most of the session working into Monday’s range but a responsive bid stepped in before Monday’s low was taken out.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to 7400. From here we stabilize before eventually taking out overnight low 7378.25. Look for buyers down at 7374 and two way trade to ensue.

Hypo 2 buyers defend ahead of 7400 setting up a move to take out overnight high 7443.75. Look for sellers up at 7450 and two way trade to ensue.

Hypo 3 buyers gap-and-go higher, trading up to 7460.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: