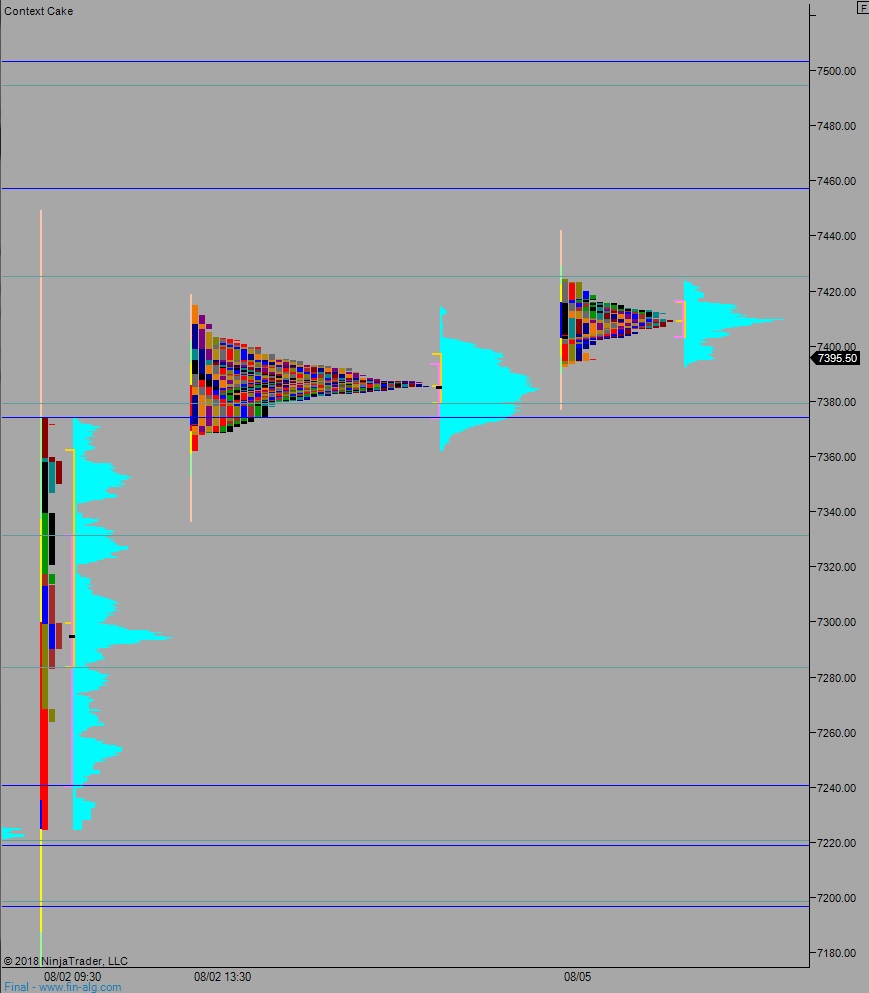

NASDAQ futures are coming into Monday with a slight gap down after an overnight session featuring normal range and volume. Price worked sideways overnight, marking time. After spending most of the evening trading above last Friday’s high, price has settled back into the Friday range as we approach cash open.

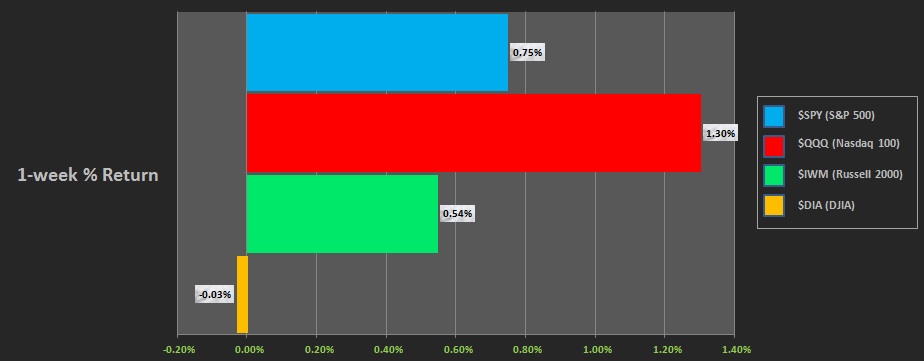

Last week also began flat, then with sellers driving prices lower off the open. The downward action discovered a strong responsive bid by Monday afternoon. The Monday responsive buy would ultimately market the low of the week. We were gap up into Tuesday and another attempt lower was met with strong responsive buying. Wednesday marked time, even through the FOMC decision. Thursday was a dynamic trend up. Friday slightly extended the gains and marked time. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal day. The first hour of trade was wide enough to contain the rest of the trading session. This is an uncommon occurrence and speaks of a lack of higher time frame participants.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7402.25. From here we continue higher, up through overnight high 7424.25. Look for sellers up at 7425 and two way trade to ensue.

Hypo 2 sellers press down to 7379.25 before two way trade ensues.

Hypo 3 stronger buyers press to 7456.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: