Greetings,

I am back inside Mothership after a few weeks living on the fringe of society, a place where time was devoted to pleasure and adventure. I took a giant drink of ambrosia from the island of Kauai and paid no attention to emails or the stock market.

Later I went to Kona big island where I had decent service on my mobile device but was happily distracted by a destination wedding that kept me surrounded around the clock by loved ones. In short, I am coming into the stock market nearly blind and this is the last Thursday in July. It seems like the perfect time to describe my process of reengaging the stock market after an extended break.

My reconditioning actually starts at the airport. I log onto Twitter to take the collective temperature of society. This only provides value because I have spent six years refining who I follow and blocking useless jerks like Montana Skeptic who was banished from my stream long ago but who Our One True Leader doxxed a few days ago and forced to STFU thank god:

I wrote about whatever the hell happened between Elon Musk and Montana Skeptic because I live and die for the discourse, baby, awwww yeah woooo https://t.co/TwgVMOnjB0

— Ryan Felton (@ryanfelton) July 25, 2018

But Twitter can be distracting. So I limit my exposure to late nights, early mornings, and diner counters. I tweeted about equality in mammal consumption, but nobody wanted to join the conversation:

I'd like to grow free range grass fed humans in the pacific northwest where the air is clean—to make to eat and to sell at high-end grocery dispensaries.

— RAUL (@IndexModel) July 25, 2018

I also saw this ironic TRADE WARS cartoon:

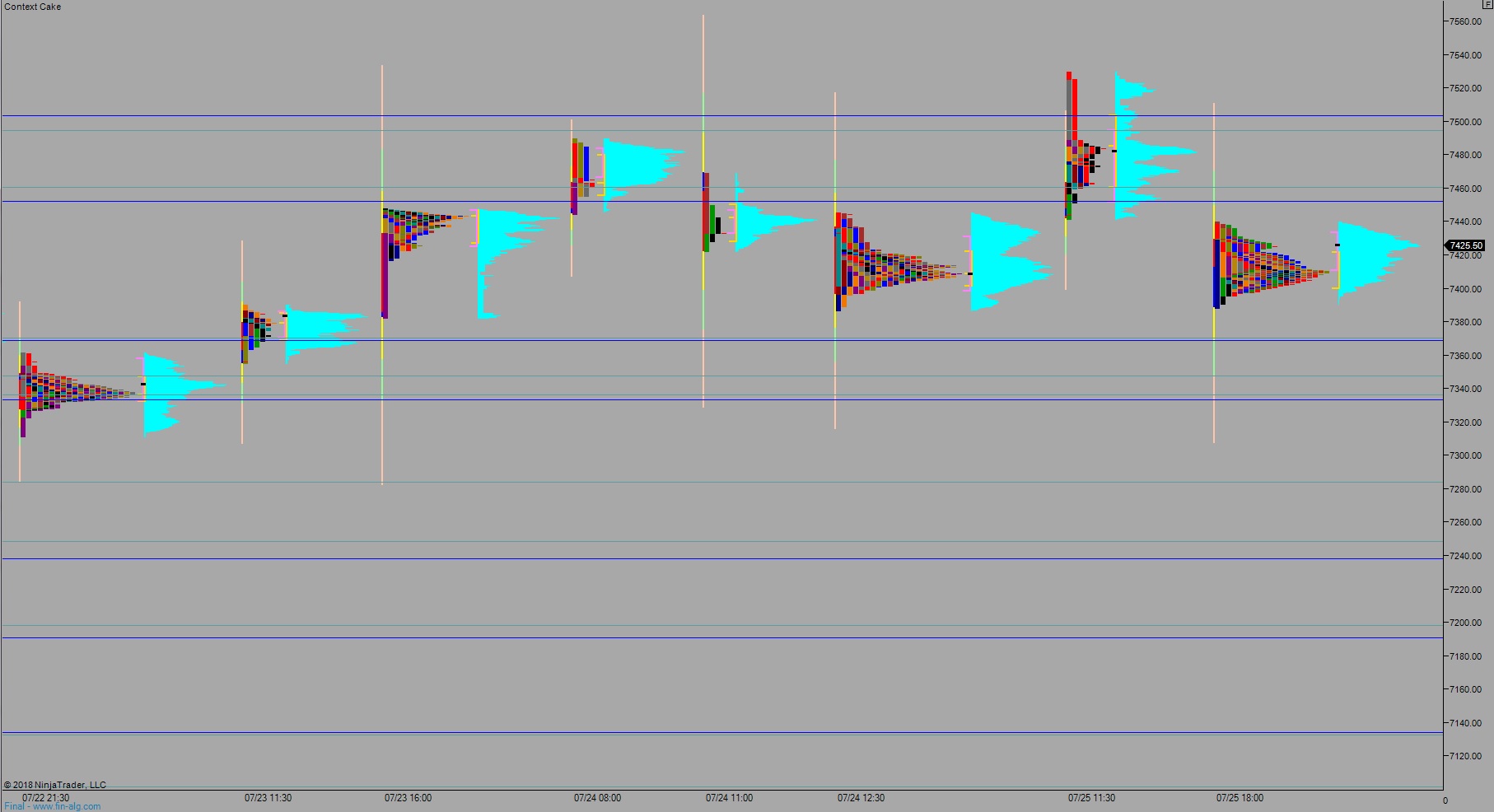

Next I open up NinjaTrader and begin splitting a 24-hour /nq_f market profile chart wherever I see a change event. In a world of 24 hour markets I need to see all activity that occurred on trading desks around the world. The American trading desks pass their books over to Japan. Japan-to-Asia, Asia/Shanghai-to-London, the Russians might meddle around at some point, London back around to New York/Toronto, and so on. A 24-hour market profile chart contains all of their interactions.

Once split into logical distributions, the chart reveals the most valuable trading levels in the industry and also begins to tell an actionable story about how the instrument I actively trade has been auctioning . Right away I am noticing that the change events that cause me to split a profile into its own blob are hardly events at all. The market is being just barely nudged out of short-term symmetry over-and-over. This lack of explosive change tells me we are in the thick of slow summer trading conditions—a potentially dangerous time where boredom can lead to action for the sake of action which usually leads to losses. Here is the updated market profile chart:

Next I score the short and intermediate term auction, nearby magnets, volume, and nearby highs/lows. I use a 15-minute candle chart with daily volume profiles and a plain old daily bar chart to see and rank these components. Each item is ranked from 1-to-5 with 1 being extremely bearish and 5 being extremely bullish. All of these scores are put into Switchboard, which is a simple spreadsheet I built to codify ‘context’ as best as possible.

It took many brutal years for me to wrap my mind around context, and I believe it is the secret sauce. The thing is nobody could explain context to me in a simple and repeatable way. So I made Switchboard in 2015 and prepared it every morning. If you had my Switchboard, maybe it would get you to a place of consistent profitability but it takes time and painful lessons. Even after time and pain you occasionally catch yourself veering off course.

Updating Switchboard involves opening up the Historical tab inside Exodus and toggling to see if either the 36-month hybrid overbought or oversold algo recently triggered. If it did, I note when it triggered and how many days it has been since the trigger and then score it into the Switchboard spreadsheet. I also note major upcoming economic events and important (to the NASDAQ) earnings due out. I can trade through both but I want to avoid being surprised by spikes in volatility.

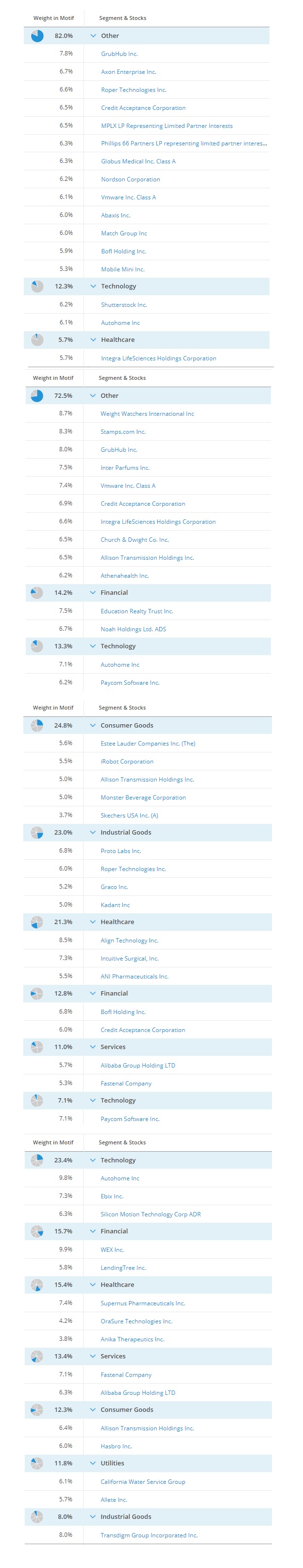

Next I check on my passive quant fund. All four legs are higher and continue to crush the S&P 500 which is nice. Several family members and friends are also in this Exodus powered fund. It is like I am a fund manager except I don’t get paid and robots do all the work. It feels good to afford these people the ability to live their best life without paying fees to some dick nose money manager who knows tiddly dick about managing money. Here are all of the fund’s current holdings:

But am I ready to trade now? No. I skipped my weekend research last Sunday (and the Sunday before). And I do not trade unless I have done all my homework. Remember all that learning pain I mentioned a few paragraphs ago? My homework routine back then was pathetically inconsistent.

Despite not being ready to trade I am in a solid mental place now and back at the main control center of Mothership. I do not need CNBC or the The Wall Street Journal. My news flow is crowd sourced through Twitter and iBankCoin, and everything I need to know about the actual stock market is all in the data.

I am informed now. I could trade if I wanted to put 5 hours into overdue research, but I am not desperate to extract moneys from the Chicago Mercantile Exchange via NASDAQ 100 futures. Like why do last Sunday’s research now, if it only affords me the ability to trade the two days left this week? That said, I am sure this Sunday’s research will take longer than usual.

Time is my biggest asset and this is how I reengage my brain to go back to thinking about taking USA fiat dollars out of the world’s financial markets—a game so pure it represents the last real form of capitalism on the planet #blessd Just imagine trying to start a new car company…and the bro-buddy conspirators you’re up against. That isn’t capitalism that’s war. Say a prayer to Elon and send blue waves of good energy towards his team of scientists and engineers. They’re gonna need all they help they can get fighting the soul-suckers at General Motors and bribed politicians who mouthpiece for Big Oil.

I hope by sharing this I help you, the reader, liberate yourself from the shackles of confusing financial news and the charlatans of high finance. Routine is routine and process is discipline. Discipline is nice and earns you autonomy because as long as you have enough US dollars and you are kind to your neighbors you can make your way though the world, no ones master no ones slave #hallelujah

If you enjoy the content at iBankCoin, please follow us on Twitter

Welcome back.

Didn’t you make a video awhile back on the criteria for your quant fund?

I did but I believe iBankCoin YouTube was banned

Really great write-up, Raul.

cheers UCB