NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range on elevated volume. Price was balanced for most of the overnight session before a wave of selling hit around 8:15am New York. As we approach cash open prices are hovering along the Thursday low.

There are no important economic events today. It is front-month option expiration day.

Yesterday we printed a neutral day. Started out gap down in range, buyers close gap, push RE up, briefly take out Wednesday high, sellers at our hypo 3 price level, then traverse the entire range and go RE down, putting us neutral, excess low formed, back to the mean by close.

Neutral.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6905.50. Look for buyers to target 6913.50 MCVPOC before two way trade ensues.

Hypo 2 sellers reject us down and out of Thursday low 6875 setting up a move to target the open gap at 6843 then then 6832.75 before two way trade ensues.

Hypo 3 stronger sellers press down to the 6800 century mark before two way trade ensues.

Levels:

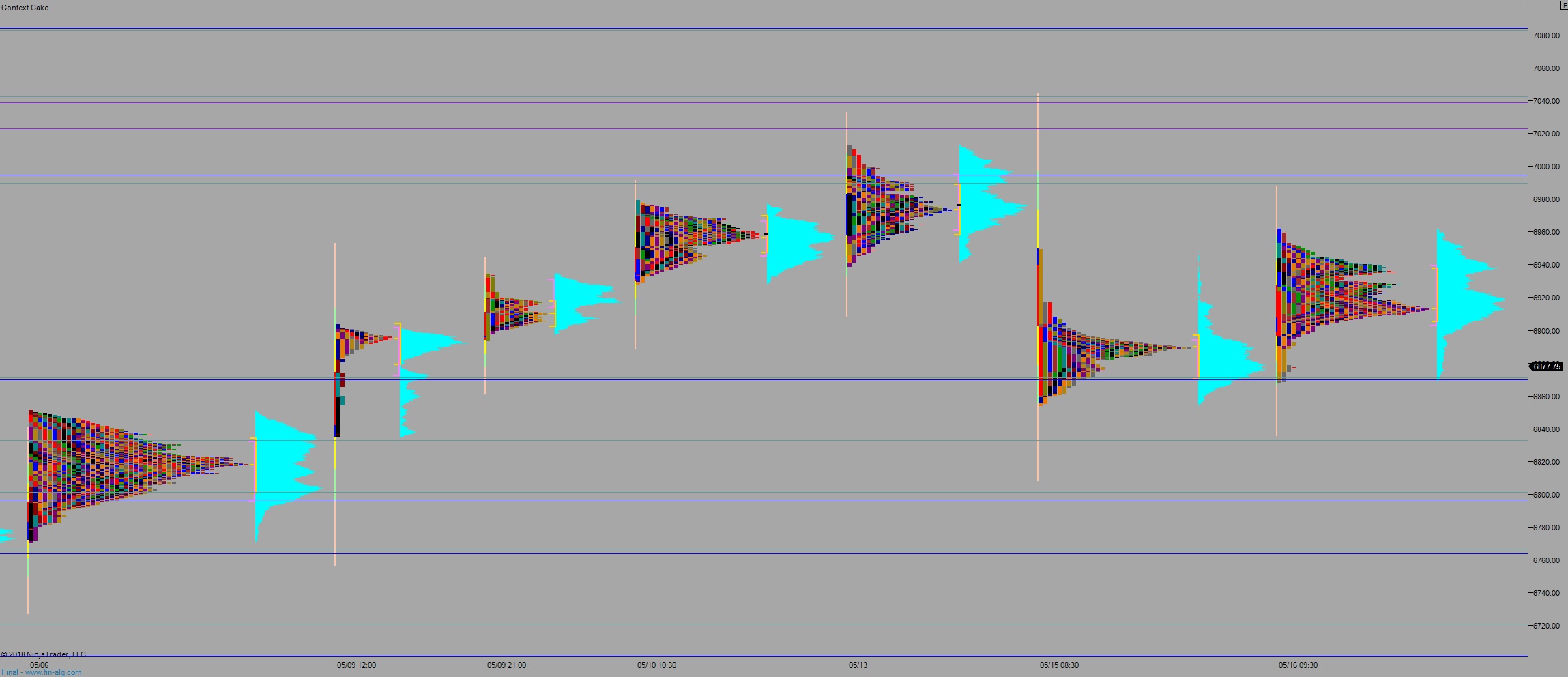

Volume profiles, gaps, and measured moves: