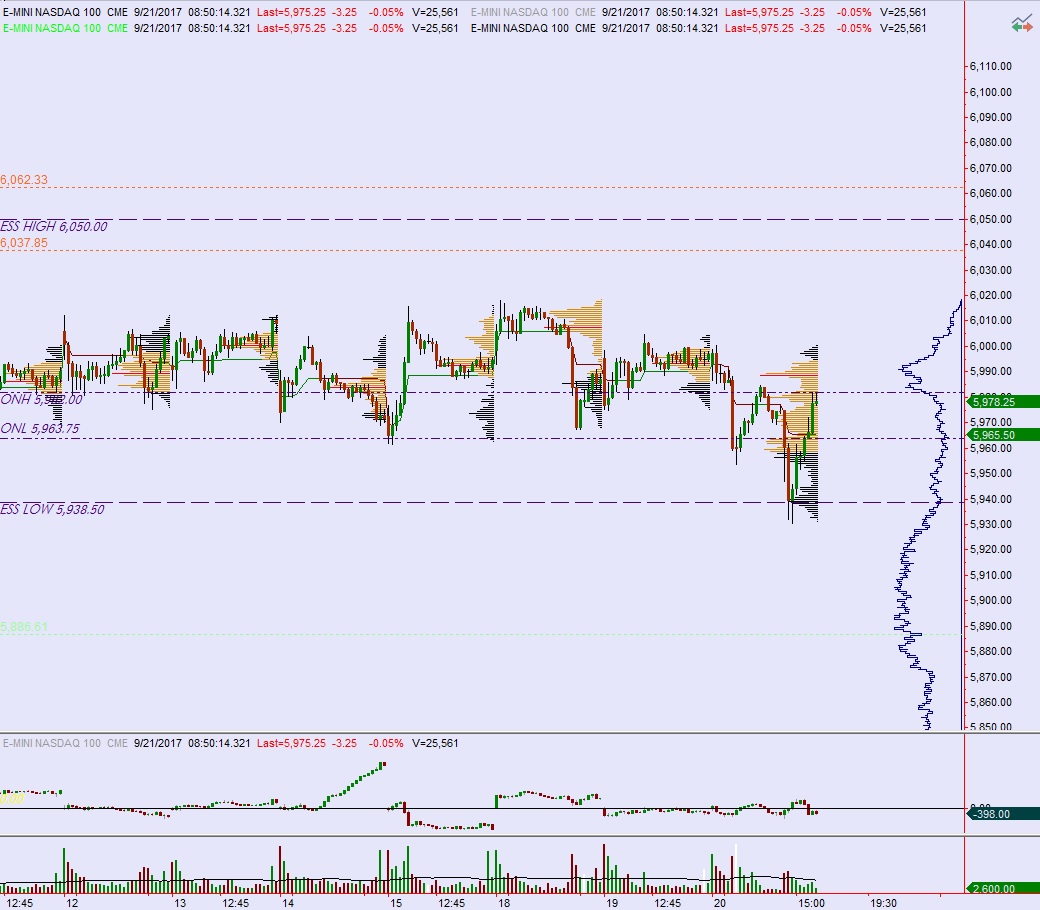

NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring normal range and volume. Price worked sideways overnight in balanced trade that held the Wednesday range. At 8:30am Initial/Continuing jobless claims data came out mixed.

Also on the economic agenda today we have Leading Indicators at 10am and a 10-year TIPS auction at 1pm.

Yesterday we printed a normal variation down. The day began flat and by late-morning sellers were driving price lower. Then we slowly drifted back up as investors waited for the Fed’s 2pm rate decision. After the Fed left their benchmark borrowing rate unchanged at 100-125 basis points sellers again engaged the market—pressing us to new lows for the day. After one more methodical rotation up, then again down, a strong bid entered the market and we ramped back up to pre-fed announcement levels.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5978.25. From here we continue higher, up through overnight high 5982 setting up a move to tag the naked VPOC at 5992.75 before two way trade ensues.

Hypo 2 stronger buyers press to 6006.50 before two way trade ensues.

Hypo 3 sellers press down through overnight low 5963.75 and sustain trade below 5940 setting up a move to target 5919.25 before two way trade ensues.

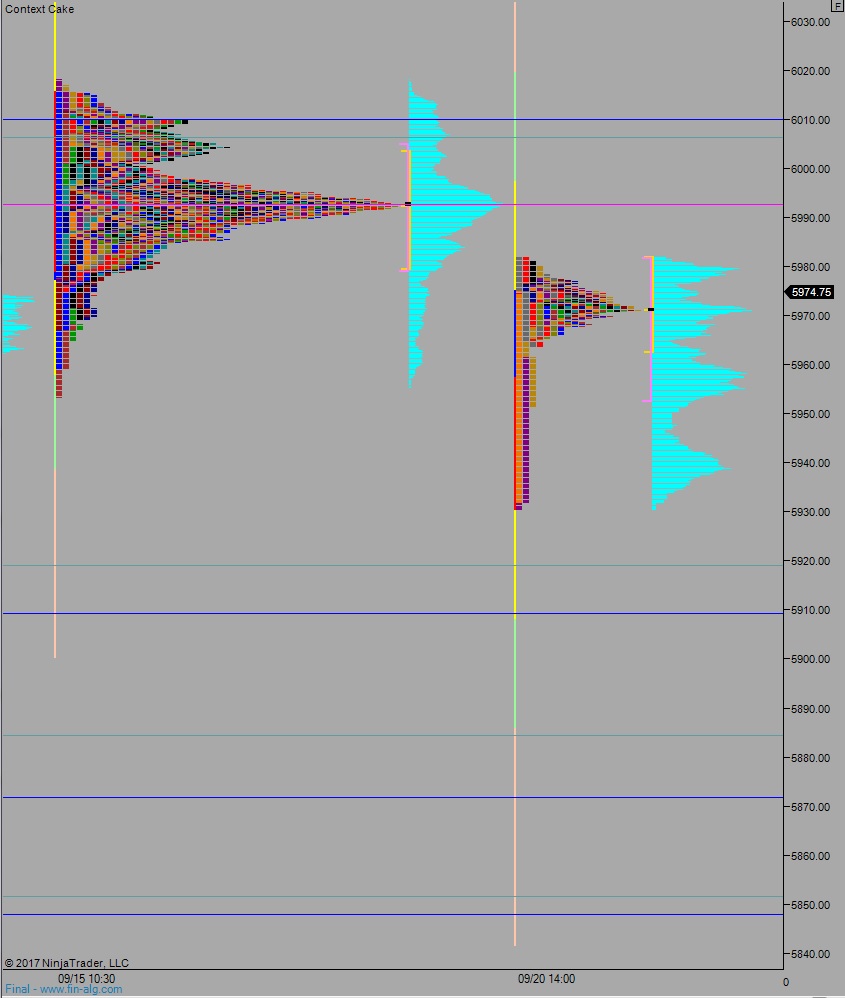

Levels:

Volume profiles, gaps, and measured moves: