NASDAQ futures are coming into Wednesday flat after an overnight session featuring normal range and volume. Price worked sideways, inside of the Tuesday range during balanced trade. At 7am MBA mortgage applications came out much lower than last week.

Also on the agenda today we have Existing Home sales at 10am, crude oil inventory at 10:30am, and the FOMC rate decision at 2pm.

Consensus among traders is that the Fed will leave their benchmark borrowing rate unchanged at 125 basis points (free money).

Yesterday we printed a normal variation up. Price made a tiny thrust lower early on but held Monday range. Then we spent the rest of the day slowly grinding higher, marking time.

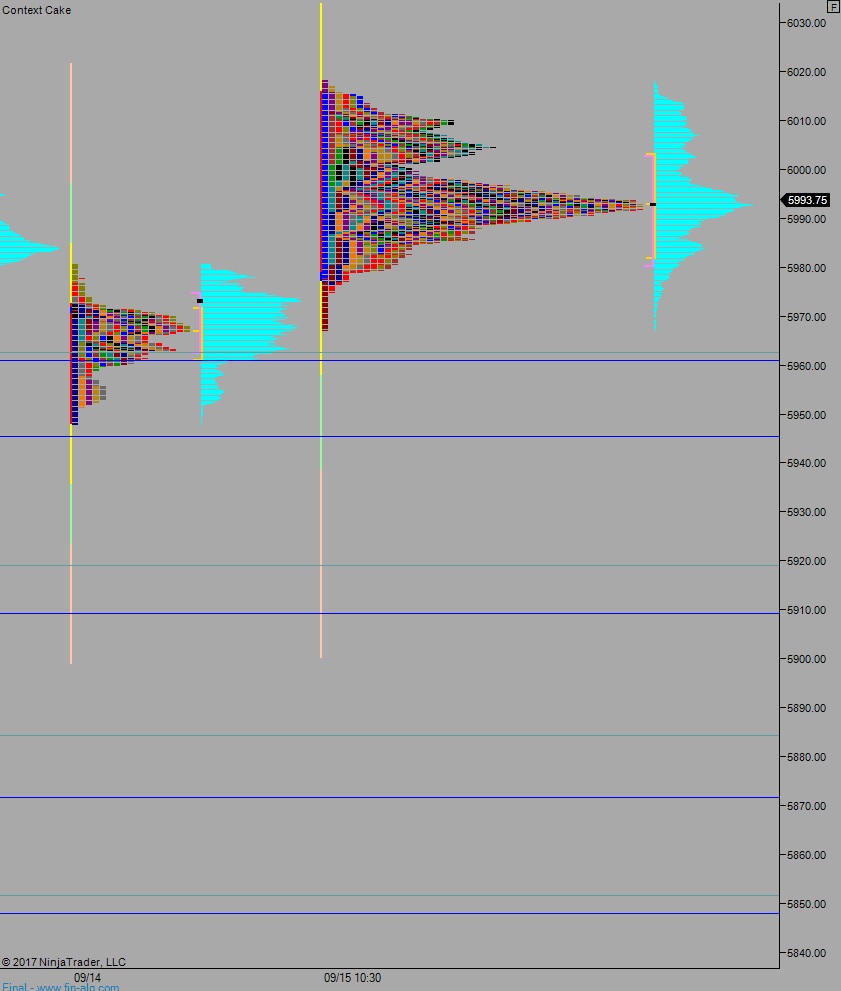

Heading into today my primary expectation is for buyers to press into the overnight inventory and work up through overnight high 5998.25. We continue higher, up to 6003.75 before two-way trade ensues ahead of the Fed decision. Use third reaction analysis post-Fed decision to dictate direction into end of day.

Hypo 2 sellers press down through overnight low 5987.75 and continue lower to 5980 before two-way trade ahead of decision. Third reaction post-Fed for direction into end of day.

Hypo 3 stronger sellers down to 5961.25 before two way trade ahead of Fed.

Levels:

Volume profiles, gaps, and measured moves: