NASDAQ futures are coming into Friday gap down after an overnight session featuring elevated volume on normal range. Price was balanced overnight, working inside of the Thursday range.

The only economic event scheduled for today is Consumer Credit at 3pm.

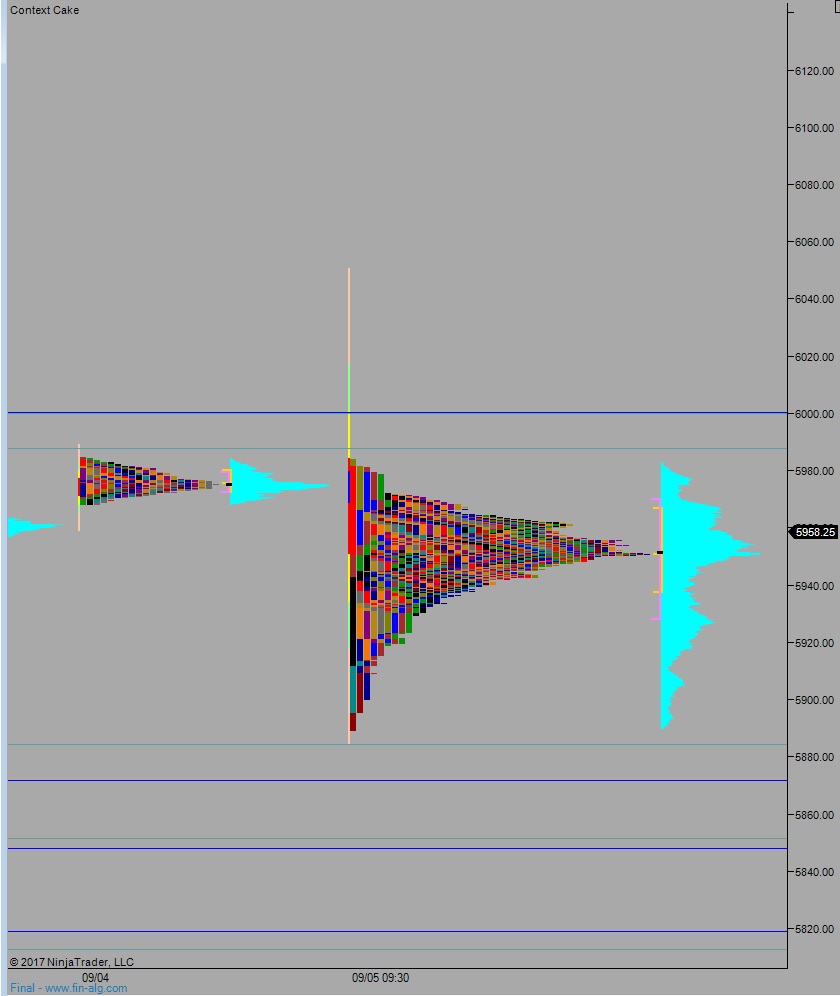

Yesterday we printed a normal variation up. The day began with a slight gap up, and once it was filled we spent the rest of the day slowly auctioning higher, working the 9/1 gap fill before settling into two-way trade.

Note: all active trading has moved to the December contract, but the price levels noted below are in reference to the September contract.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5978.50. From here we continue higher, up to 6000 before two way trade ensues.

Hypo 2 sellers press down through overnight low 5948.50. Look for buyers ahead of 5920 and two way trade to ensue.

Hypo 3 stronger sellers press down to 5884.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

For an amature the chicanery these past couple days is untradable, my dials are all over the place, bizarro world. Does the rollforward mayhem take about 2 days usually?

Does anyone actually day trade these days? I wait and watch and wait and watch but cannot often bring myself to hit any buy buttons. This is the most surreal market in my life history. Today’s MM’s are psycologists rather than financial gurus.