NASDAQ futures are coming into Friday flat after an overnight session featuring normal range and volume. Price worked up through the Thursday high, briefly overnight before settling into balanced trade. At 8:30am Housing Starts and Building Permits data were below expectations.

Also on the agenda today we have the June preliminary reading of Confidence out of the University of Michigan. There are no other major economic events.

Yesterday we printed a normal variation up. The day began with a gap down and sellers working down through the Monday low. Just a touch below Monday’s low buyers stepped in. We then spent the rest of the day trading higher. As a result, it appears we have failed auctions on both sides of the tape now.

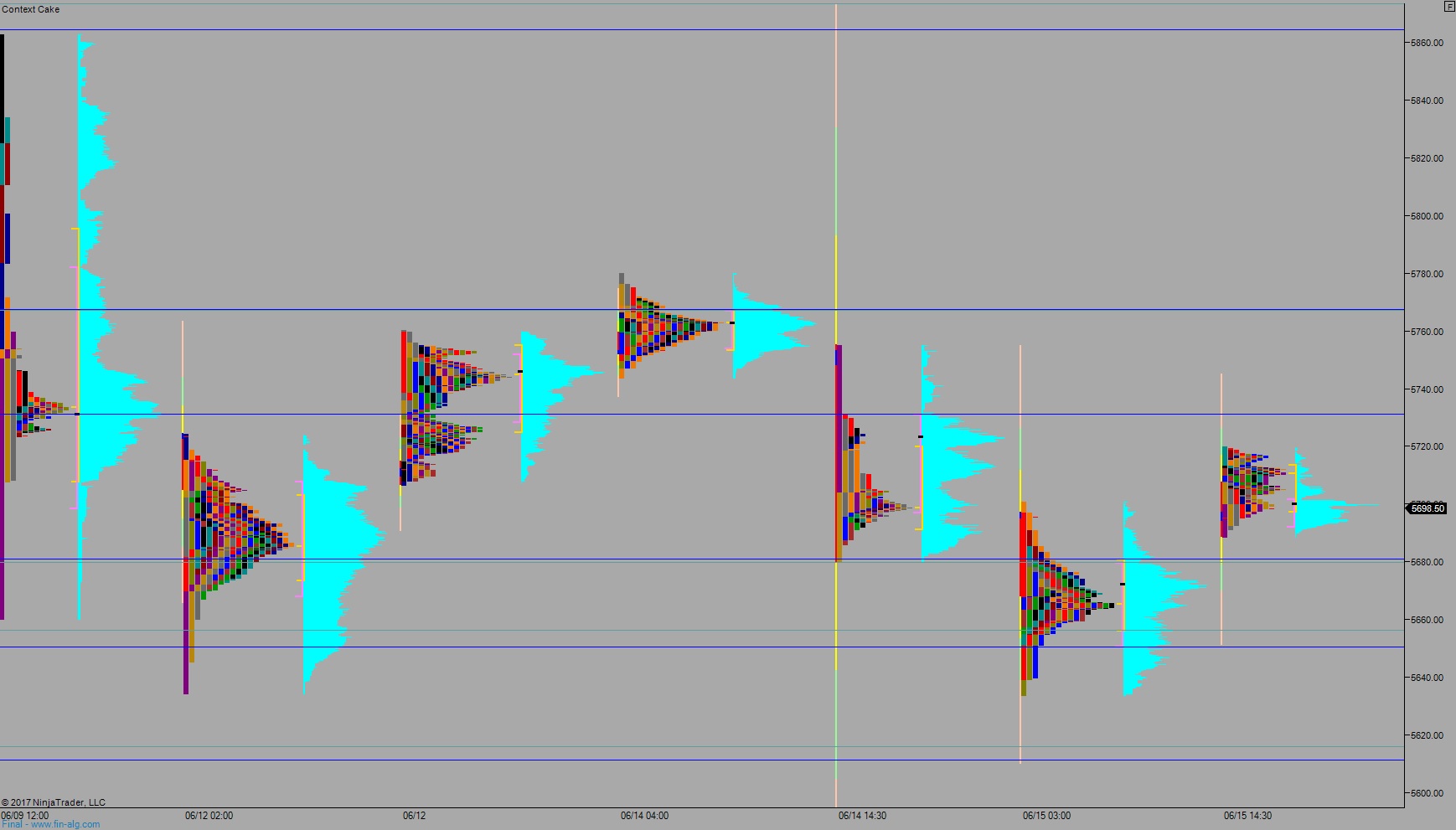

Heading into today my primary expectation is for buyers to work up through overnight high 5720 and close the Wednesday gap up at 5733 before two way trade ensues.

Hypo 2 stronger buyers press up to 5767.75 before two way trade ensues.

Hypo 3 sellers press down through overnight low 5695.75 and buyers are found just below at 5681.50.

Hypo 4 stronger sellers send trade down to 5656.50 before two way trade ensues.

*Note: all levels are in reference to the June contract despite all active trading moving to the September contract.

Levels:

Volume profiles, gaps, and measured moves: