NASDAQ futures came into the first day of May gap up after an overnight session featuring normal range and volume. Price worked higher, uninterrupted, overnight, pushing the index to new all-time highs ahead of the opening bell. At 8:30am Personal Expenditure core data came out mixed, slightly below expectations.

At 10am ISM Manufacturing came out below expectations. Sellers pushed on the release and are gaining some traction.

Also on the economic docket today we have a 3- and 6-month T-bill auctions, $39bln and $33bln respectively.

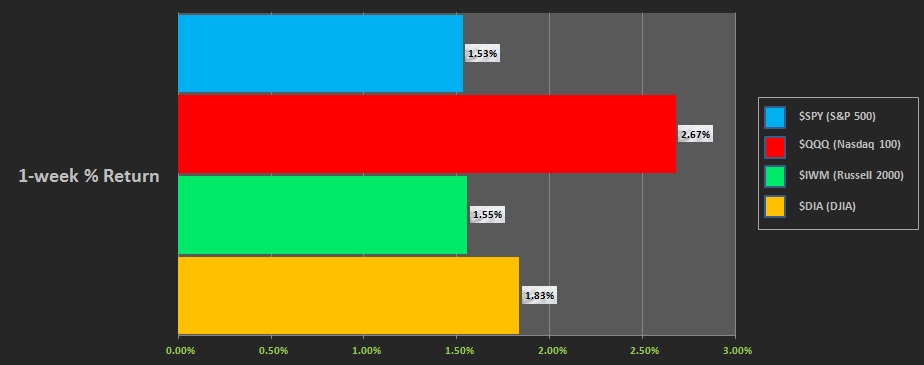

Last week began with a strong gap up and buyers continuing their campaign higher for most of the week. The performance of each major index last week can be seen below:

On Friday the NASDAQ printed a normal variation down. The day started out flat and sellers worked price lower, pushing into the spike seen Thursday afternoon after Amazon reported strong earnings. The NASDAQ eventually balanced out Friday, closing near the session midpoint.

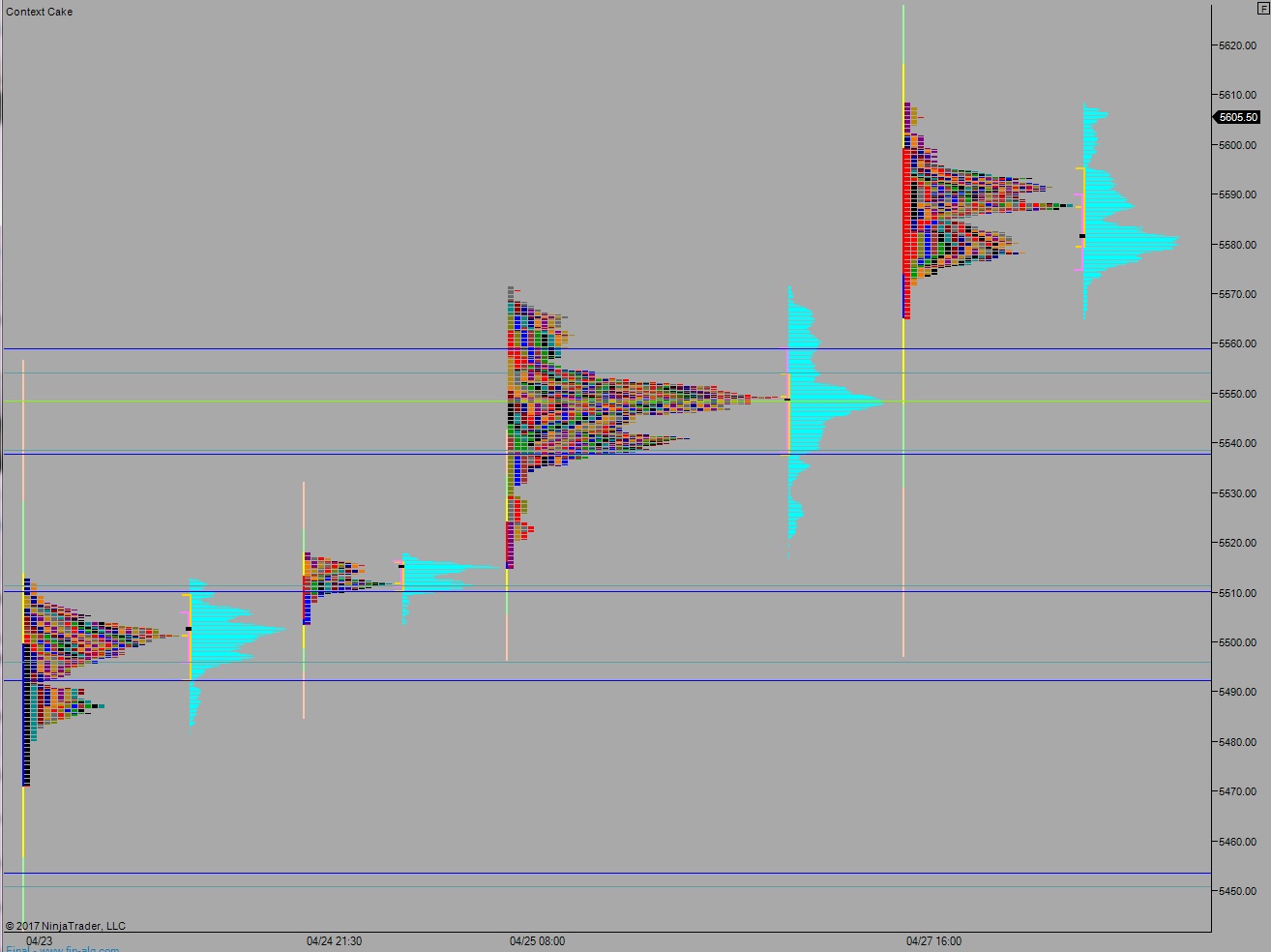

This morning began with an open auction outside range. The first break from the range was higher after buyers rejected an attempt to move back into last Friday’s range.

My primary expectation today is for buyers to continue working higher. There are no reference points above, but look for two-way trade to ensue around 5620.

Hypo 2 sellers work into Friday’s range and probe down to 5559 before two way trade ensues.

Hypo 3 strong buyers work up through 5625.25 and sustain trade above it, setting up a trend day.

Levels:

Volume profiles, gaps, and measured moves: