NASDAQ futures are coming into Monday gap down after an overnight session featuring elevated range and volume. Price opened gap down Sunday evening and continued lower, pressing into levels unseen since late-February, effectively erasing all of March’s gains before bidders stepped in and worked priced back into the low-end of last week’s range.

The economic calendar is light all week. Today the U.S. Treasury is auctioning off 3- and 6-month T-bills at 11:30am, $39b and $33b respectively. They are also auctioning off some 2-year Notes at 1pm, $26 billion dollars worth of tier one American debt.

There is some Fed speak Evans is talking before and after lunch and Kaplan in the evening, but investors aren’t likely to pay much attention to them. Yellen speaks Tuesday mid-day and may garner the interest of active market participants.

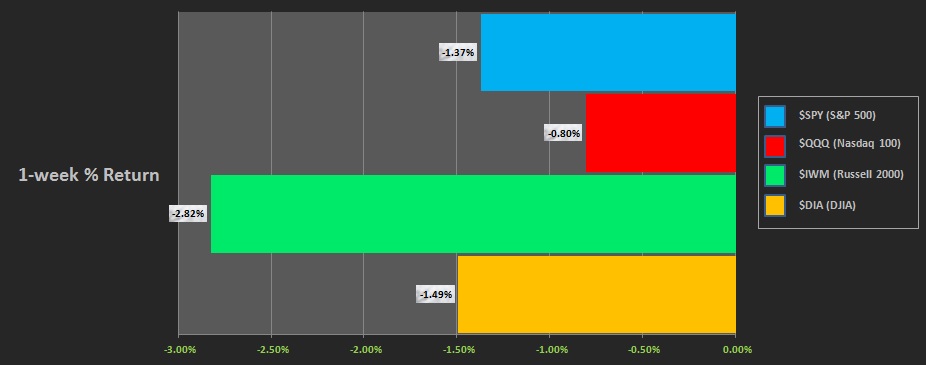

Last week we went lower, primarily on Tuesday. Last Tuesday was a big trend down across the board. While most other major indices bear flagged for the rest of the week, the Dow and S&P continued to trickle lower. Below is the performance of each major index:

On Friday the NASDAQ printed a neutral day. A gap higher into the day was bought initially, pressing about halfway into the Tuesday trend down seller conviction day. Buyers pressed range extension up, albeit briefly, before we traversed the entire daily range and worked lower, effectively closing the Friday gap before a 3:30pm ramp put us back into the middle of the Friday range. Neutral action.

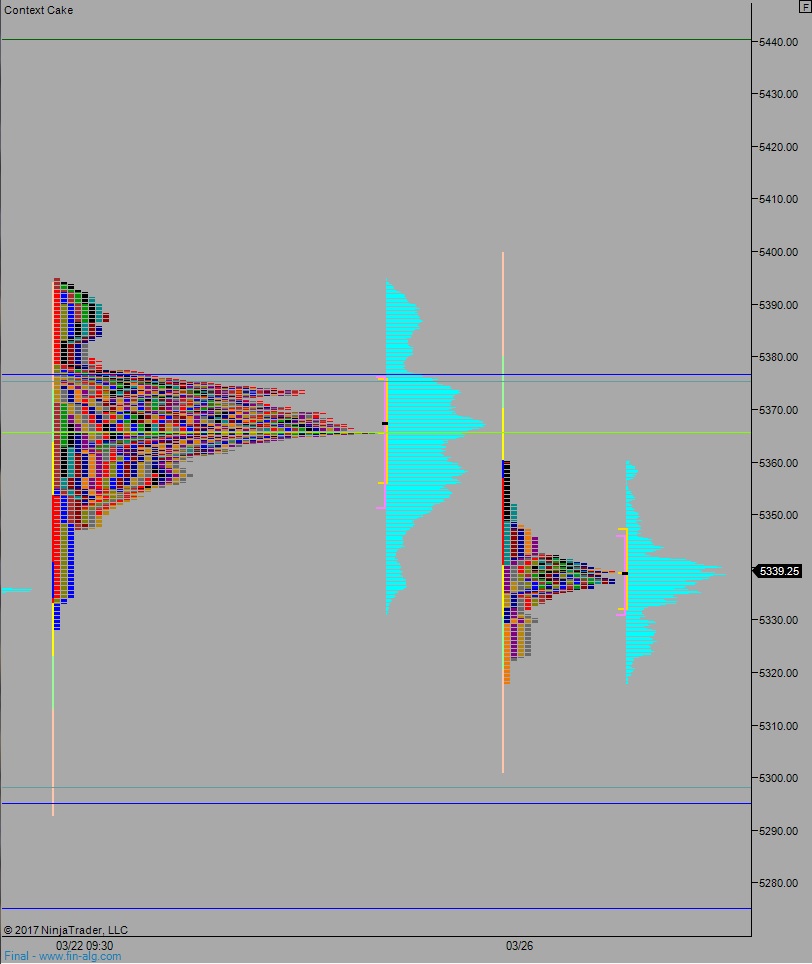

Heading into today my primary expectation is for buyers to work into the overnight inventory, working up through overnight high 5360.25. Buyers stall out here, perhaps lurching a bit higher to 5365.50 but failing to close the weekend gap. Instead we roll over and churn along last week’s lows, around the 5350 area.

Hypo 2 sellers gap-and-go lower, taking out overnight low 5318 and targeting the 5300 century mark before two way trade ensues.

Hypo 3 buyers press strongly, up through overnight high 5360.25 and up to the weekend gap at 5379.25. They sustain trade above 5377 setting up a move to target the 5400 century mark (perhaps later this week).

Levels:

Volume profiles, gaps, and measured moves: