A full month of bullishness is set to reach a crescendo of sorts, come Wednesday, when we embark on the second month of trade under our new political regime.

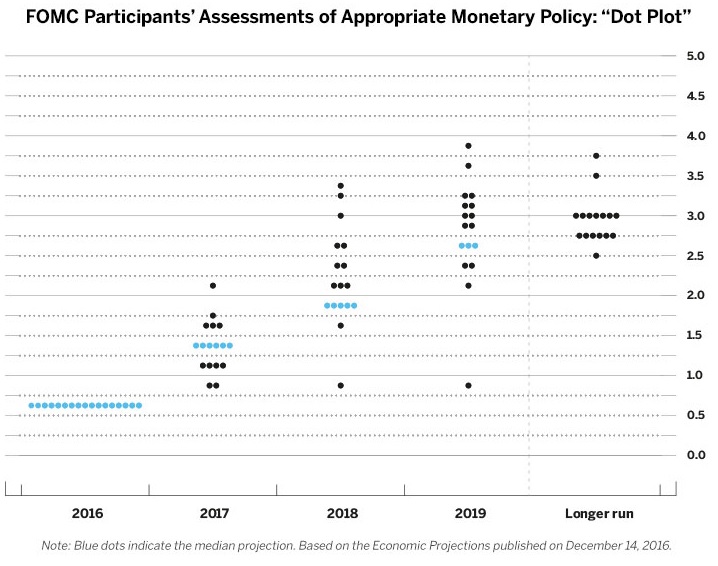

It also comes with a Fed rate decision. Consensus down at the Chicago Mercantile Exchange is for no change in rates (96% probability). However, and with the stroke of her pen, the venerable Janet Yellen, backroom leader of the free world, could send a chill down the collective spine of investors by unexpectedly raising rates.

This would be bad because, for more than a year now the Fed has been boringly predictable. That’s a good thing, in case you’re wondering. It would be a shame to destroy all the goodwill they have built. According to the “Dot Plot” chart, we only need to nudge a touch higher from our current benchmark rate to be in the happy blue zone:

The NASDAQ, according to ticker symbol $QQQ is up about 6% in the month of January. How does that compare to other January performances? Best since 2012.

Remember 2012? 2012 was really bullish, man.

So let the common man scuffle in the streets, complaining about this or that, wasting their time in a feeble attempt to share their two-cents on the current state of affairs. Your time and money can be better used foxing around, capitalizing on all the otherwise neglected opportunity.

This week’s model scores support remaining in the bullish labor camp. Laboring away, with dollars allocated to three and four letter acronyms.

Exodus members: the 116th Edition of Strategy Session is live. Go check it out for more details on what we expect from the upcoming week.

If you enjoy the content at iBankCoin, please follow us on Twitter