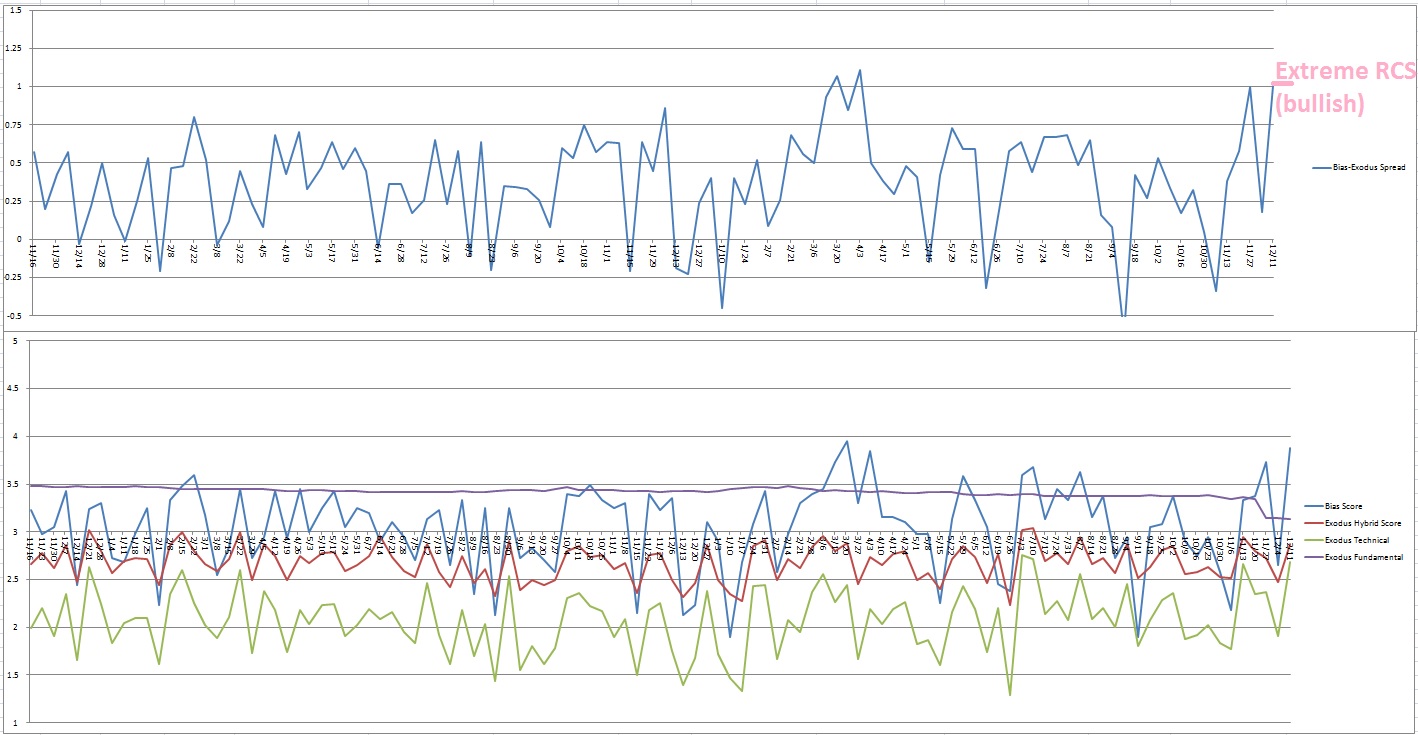

The results are in. After tabulating the data from last week’s rally and inputting forecasting metrics for next week, the IndexModel is issuing a winter rally warning.

The model registered some of the highest scores ever, bested only by the extreme bullishness seen in early April.

Fed fund futures over at the CME show a 94.9% probability of a rate hike Wednesday from the FOMC. Thus far, despite the high probability of an event historically seen as bearish for equities, markets are careening higher.

This may be due to investor perception on the economy being robust enough to sustain a rate hike, and that being bullish. Or, this could be the bow on a legacy stock market for President Obama, who gave us the finest stock market of our lifetimes.

At iBC labs we don’t particularly care to dwell on the ‘whys’ of the world, instead focusing on expectations and how we intend to extract currency from the market regardless of its behavior.

Heading into next week, the plan will be to find ways to go long before the Fed meeting, then to use the post-meeting reaction to dictate our bias into the second half of the week. Simple.

The world is aglow, tinted rose by the stock market gods. The best of times, enjoy!

Exodus members, the 109th Exodus Strategy Session has been published. Go check it out!

If you enjoy the content at iBankCoin, please follow us on Twitter

motto seems to be we rally until inauguration

Hey Raul,

Appreciate your strategy sessions every Sunday, very nice review I like to add to my weekly preparations.

When you look at hybrid change % on the market to judge future moves and like to see a “trend” change being marked by a hybrid % change that outsizes the last one by a larger margin how far back do you let the reference # get ? 1 month.. 1 week? And then what do you look for to find a new more recent number, simply the next largest? Example – the +14.75% on Nov 7th had no contenders for too long so you chose to accept the Dec 5th print of +8.9% as your next reference number.

Thanks