Next week sets up November, which sets up Thanksgiving, Black Friday, the “Santa Claus” rally, Christmas and year-end.

And while the outcome of the election is likely to impact the market, the auction theory model, a working model built inside Exodus using cold logic and dead numbers, is providing trading insight for next week.

Writers note – I always take my signals, even through major world events. The huge gap down post BREXIT, for example, turned out to be the best performing Exodus buy trade so far in 2016.

Since we have Free Exodus Trials going on this weekend, here is this week’s Executive Summary, a STOCK MARKET PREDICTION based on probabilities and past observation:

ELECTION PREDICTIONS:

Hillary wins. Perhaps my microcosm skews my expectations but easily 8 out of 10 people I know will vote HRC. Also, even WikiLeaks founder Assange admits “they” won’t let Trump win.

Following the election she will be indicted and removed from office. The jig is up for the Clintons. Kaine will be president.

POST ELECTION PREDICTIONS:

There will be no revolution from the rad-right. Winter will suffocate their fires. They will return to their manufactured homes and opiate addictions.

Big Pharma will continue to thrive and surpass Big Oil to become the largest lobbying group in Washington DC.

Venture capitalists will continue to front run public investor interests, greedily hoarding the best investment opportunities in the world (like Uber, DJI, or Snapchat) until they are ready to cash out onto the fucked-five-ways-to-Sunday general population (see GPRO or TWTR).

Medical costs will continue to rise, but so will subsidies so fret not unless you believe imagined realities like national debt matter (see central banks).

ISIS will continue to grow with support from the shepherd princes of Qatar.

In short, life will go on. Modus operandi.

I hope you enjoyed the show. I realize most of my readers did and also that my real life friends and family unanimously stuck their heads in the sand.

SIDE NOTE ON ALL THE WIKILEAKS:

The food emails from Podesta and team being code for child trafficking nonsense? Stop, you all look like demented crazy folk.

The “Spirit Cooking” paranoia of devil worshiping? Come to Detroit sometime and I’ll show you some bizarre events—it’s hedonistic entertainment.

Podesta’s brother does sound like a sick fuck, with his dick out Jesus painting and room full of nubile portraits. His preferred wall decor isn’t just a conversation piece for cultured socialites; he’s a creep. Whether John is also a pervert is hard to say, but I’d imagine there is some defect in their lineage.

The only revelation that came from WikiLeaks is the $1,000,000 gift to the Clintons in 2011 when Hillary was in the State Department. Liberals will condemn Trump for having “white supremacist” people retweeting him, but have zero qualms with an oppressive country that publicly lashes/stones gays, a country that mutilates female organs to eliminate pleasure regions, supporting Hillary Clinton.

Who has the bigger obligation to bad people? The one with the retweets, or the one with a million dollars?

Use your brain.

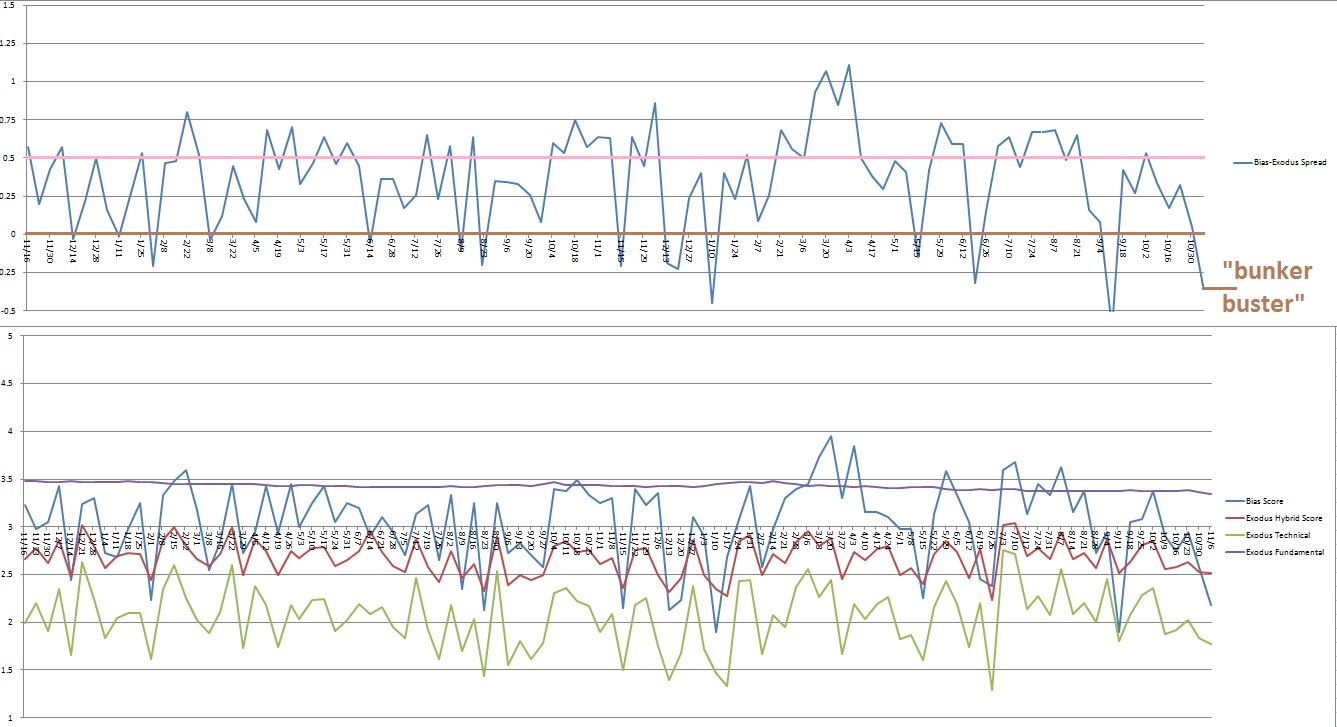

HISTORICAL MODEL SCORES:

RECAP OF EVERY BUNKER BUSTER ON RECORD:

9/11/16

All major indices came into last week gap down and rallied higher all Monday. This marked the weekly low. Then, for the rest of the week the NASDAQ worked higher while the other indices went sideways.

6/19/16

We came into last week gap up, well above the weekly ATR band on every major U.S. equity index after polls and other data came out suggesting the United Kingdom was likely to vote against leaving the European Union. An early Monday rally was faded and we ultimately closed on the session low—but the gap into the week remained. This low held through Thursday the markets rallied hard into Thursday afternoon.

Friday, overnight, we learned the UK voted themselves out of the EU, and the market fell nearly 250 NASDAQ points off the high. The open on Friday featured a strong reflex rally right up to the gap we left behind two Friday’s back. From there the market rolled over, traversed the entire reflex rally, and closed out on session low.

5/15/16

Major indices basically tested higher early in the week, tested lower later in the week, and balanced out by Friday. Most indices worked slightly higher through the balance with the Dow Jones Industrial Average lagging behind.

1/10/16

Last week started with a gap up that was faded. The selling pressure Monday was mild and the market ultimately discovered a strong responsive bid by the end of the day. Tuesday opened gap up, tagged the upper ATR band, then slowly rotated lower to close the gap down. Again, a strong responsive bid was discovered and the day closed strong.

Wednesday, after opening with a small gap up, price reversed lower and had a slow grind lower through the morning and lunch hour. The selling accelerated into the afternoon and we ultimately printed a trend day down.

Thursday the selling continued through the early morning before again discovering a strong responsive bid. We spent the rest of Thursday trending higher before sellers stepped in at the end of the session.

Friday saw a pro gap down to a new weekly low. The action on the session was balanced and ultimately formed a decent-looking excess low before reversing and closing above session mid.

12/20/15

Equity indices started the week gap up and after an early fade lower price spent the rest of the holiday shortened week trading higher. Equity products closed for trade at 1:15pm on Thursday, Christmas eve and remained closed Friday in observation of Christmas day.

12/13/15

Markets started the week gap down and sold fast. By the afternoon responsive buyers stepped in. Tuesday the market opened pro gap up and traded in balance. The balance continued up to the FOMC rate decision Wednesday afternoon, after which we rallied.

Thursday we gave back all of the rally from the FOMC event and Friday sold hard, taking price back to about where the week started.

11/15/15

Equity indices started the week with a small gap down and trended higher all day Monday. After a balanced session Tuesday, price spent the rest of the week trending higher.

Friday price appeared pinned into a tight range but overall carried a slight upward drift.

8/22/15

Arguably the most eventful week of the year, stock markets started the week with a major gap down. The NYSE invoked rule 48 before opening bell [it was also invoked Tuesday and Wednesday] in an attempt the quell volatility.

Price drove lower off the open as several stocks and ETFs became dramatically mis-priced. Price sharply snapped higher and by Monday afternoon the Nasdaq was about 275 points off the low. By the close Monday most of those gains were given back. Tuesday opened gap up, buyers made an early push, but ultimately price rolled over, closed the overnight gap, and closed near session low.

Wednesday price opened gap up, sellers pushed into the overnight inventory but struggled to fill the gap before buyers came in and closed price near session high. Thursday price opened gap up and churned with a slight upward drift and Friday price drifted sideways, marking time.

There were four neutral days in a row this week on the Nasdaq. Quite the rare event.

8/9/15

Price came into the week with a big gap up. Buyers kept the pressure on most of Monday before finding responsive sellers late in the session. Tuesday price opened gap down and after some aggressive posturing from buyers and sellers we liquidated lower. The selling continued overnight and Wednesday we opened to a 3rd big gap, lower, and sellers pressed for most of the morning.

Before lunchtime Wednesday buyers responded and began buying. The indices threw down a classic smoke screen with the Nasdaq going range extension down while the rest diverged. After bouncing off the lows, strong reversal and trend higher pressed for the rest of the day. Thursday and Friday were quiet, summer grind-type sessions.

06/14/15

Stocks came into the week with a big gap down and spent the first half hour liquidating lower. Price managed to exceed the prior week’s low before responsive buyers stepped in. At that point the auction reversed and price began working higher. Price continued higher into Wednesday morning before sellers worked in ahead of the Wednesday afternoon FOMC rate decision.

The third price reaction was a buy after the decision which led into a trend day up Thursday. Friday price faded lower but we ultimately closed higher on the week.

3/8/2015

Equities started the week with a small gap up and drifted higher for much of the session before finding responsive sellers (responsive relative to Monday’s open, initiative relative to the prior week’s breakdown) who knocked stocks off the highs. Then Tuesday price opened to a large gap down and trended lower for most of the session. The selling carried into Wednesday and Thursday price went gap up and traded higher. Friday bulls tried to build from their bounce but were overwhelmed by selling which took out Thursday’s swing low before finding a sharp responsive buy near the end of the day

2/1/2015

Stocks opened for trade Monday with a slight gap up and promptly sold off during the first 45 minutes of trade. Price exceeded the swing low from the prior week before finding a strong responsive buyer. The reversal continued into the afternoon and throughout most of the week. This action carried us to the high end of our intermediate term range.

Early Friday morning the markets continued higher after a stronger-than-expected Non-Farm Payroll report and revisions to the prior month. The move stalled out by lunch time and we saw sellers enter and push the market lower slightly to end the week.

1/11/2015

Prices worked lower across the index markets for most of the week after coming into Monday with a small gap up. Volatility was already elevated but truly increased on Tuesday when an early rally was rejected sending the market careening lower. Many large banks reported earnings throughout the week and one after another traded lower [see: WFC, JPM, BAC, C, GS, PNC].

Then, early Thursday morning [premarket] the Swiss National Bank announced it would remove the cap it had in place to prevent the Swiss franc from rising too high against the Euro [Source: Bloomberg Businessweek, click here]. The Central banking move drove one of the biggest shakeups in foreign-exchange history. However, US stock indices showed signs of short term stability and held value.

12/14/2014

After closing the prior week (12/12) on a weak note, going out at the lows, equity markets were gap up Monday morning. The globex buyers were quickly tested Monday when markets sold off and continued lower through Tuesday. By Wednesday morning we started seeing signs of buyers as we went into the afternoon FOMC rate decision and Yellen press conference. The news received a positive reaction and enticed more buyers into the market. Thursday prices opened to a big up gap and we continued grinding higher for the remainder of the week. Also, the Russell 2000 began showing relative strength Wednesday.

FINAL RECAP:

Look for a tradable low this week. Look for Clinton to win. Look for her to be indicted and removed from office. Look for life to go on.

If you enjoy the content at iBankCoin, please follow us on Twitter

Raul – it should be a very interesting week to be blogging. Bottom line on this election biz: I’ve lived under crummy presidents my entire life…yes, ALL of them, and have continued to thrive. One can’t expect a president (or anyone else) to be a driving force in their success. Spoken as a thorough ham & egger, and not a Libyan ambassador.

The worst possible scenario would be a tie, which is exactly what will happen.

You, sir, are an idiot.

Thanks for correcting the record.

Quick question, dominos play better with cheese or pasta?

Maybe Denny Hastert knows the answer?

I’d ask you to take your daily dose of red pills and steer clear of those blue ones. That isn’t hedonistic entertainment. It is, without question, satanic ritualistic, dark, foreboding worship.

Fly is a closet HRC fan… the right-wing bluster is all about the clicks. Same with his alterego Ironbird. Wouldn’t mind a bit if HRC got booted. Like Kaine better anyway. But forget this indicted nonsense. Just stupid. Time for all to grow up.

Kaine is great. Such a force of good.

Uggh… what’s wrong with him…in league with New World Order? Guess all those years as a missionary were a fraud.

Fly.. you were conned by the world’s biggest snake oil salesman. All those street smarts you boast about were nowhere to be found. Give me a single of example of Trump ever doing anything that didn’t personally benefit him. Times up..never. NEVER. He has taken more money from Middle East scumbags than anyone. The ones who really do fund ISIS if you know anything about the Middle East. So sad.

cuckold.

Will you be attending Trump’s Hilton Hotel shindig? A germaphobes nightmare.

Should we compare charitable donations? That Trump wouldn’t agree to the apprentice unless it was a format that was educational? Also, the premise of the question is dumb. You can do things that are self serving but do a lot more good in society than if you didn’t do them at all. He enriched himself, but in the process how many people got higher paying jobs than they would have if he hadn’t? How many contractors and subcontractors received work? How many charities got extra awareness and attention because of the format of the show the Apprentice?

Plus, if you think Hillary is so great, then you can at least admit Trump giving Hillary and other democrats around a million dollars total at least made their career easier.

By the way, Hillary’/s personal enrichment involved taking money from Qatar and other anti freedom nations, most likely in exchange for foreign policy favors or some quid pro quo not in the American’s best interest.

Raul… regardless of how the election turns out I want to thank you for at least having the decency to entertain opposing views.

Trader, you like Kaine, seriously?

TC is a shameless supporter of mercenaries agents whose sole goal is to destroy the country from within.

Mercenaries agents? No idea what that means. I am a trained killer.

What’s wrong with Kaine other than he’s honest and altruistic?

Great post Raul, thanks.