NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher from Monday, pushing near last week’s high before settling into two-way trade.

The economic docket is extremely light today. There is a 4-Week T-bill auction at 11:30am.

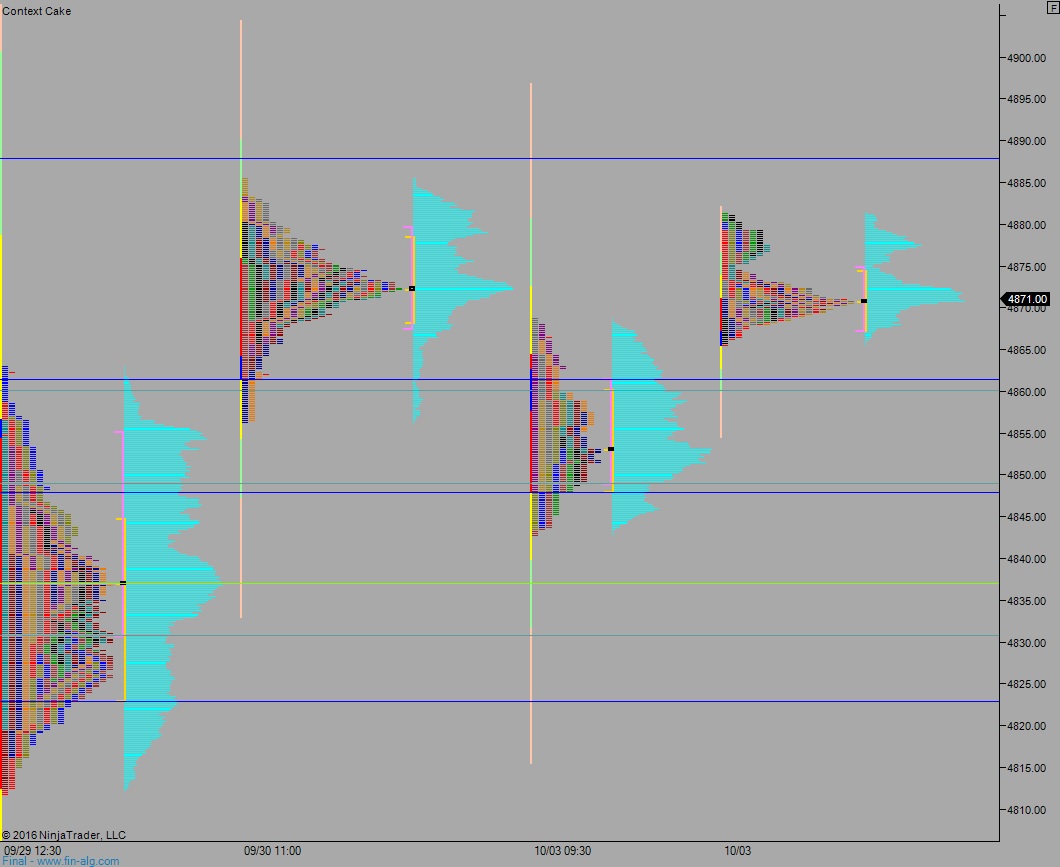

Yesterday we printed a neutral extreme up. After a gap down into the week, sellers made an early push. Their actions stalled out by 10am. A weak low formed before we made a quick push to range extension up and close the weekly gap. Responsive sellers were found up here and we traversed the entire day’s range to go neutral. Sellers could not, however, take out last Friday’s low. Instead they printed a failed auction before we again traversed the entire range to close near session high, earning the session its ‘extreme’ nomenclature.

Heading into today my primary expectation is for sellers to work the overnight gap fill down to 4866.50 then take out overnight low 4864.75. Look for buyers down at 4861.50 and two way trade to ensue.

Hypo 2 buyers work up through overnight high 4881.25 and close the open gap up at 4886.50. Sellers defend at 4887.75 and two way trade ensues.

Hypo 3 strong buyers take out overnight high 4881.25, take out open gap 4886.50 and sustain trade above 4887.75 setting up a move to target teh 4900 century mark. Stretch targets are 4907 then 4916.

Hypo 4 strong sellers push down through 4861.50 setting up a move to 4849 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: