NASDAQ future are coming into Friday, month-end/quarter-end, with price unchanged after an overnight session featuring a normal range and elevated volume. The market worked down through the Thursday low briefly (by 3-ticks) before reversing and pushing back up through the Thursday midpoint. At 8:30am Personal Income/Spending data was inline with expectations.

Also on the economic docket today we have U. of Michigan confidence at 10am, Fed’s Kaplan speaking in Dallas at 1pm, and also the Baker Hughes rig count at 1pm.

Yesterday we printed a normal variation down. Price opened gap down and once the overnight gap was filled sellers began driving price lower, down through the Thursday low. This set up an even harder down rotation (news driven, $DB) and finally a small 3rd rotation which probed near the weeks low before finding a strong responsive bid to close the day near its midpoint.

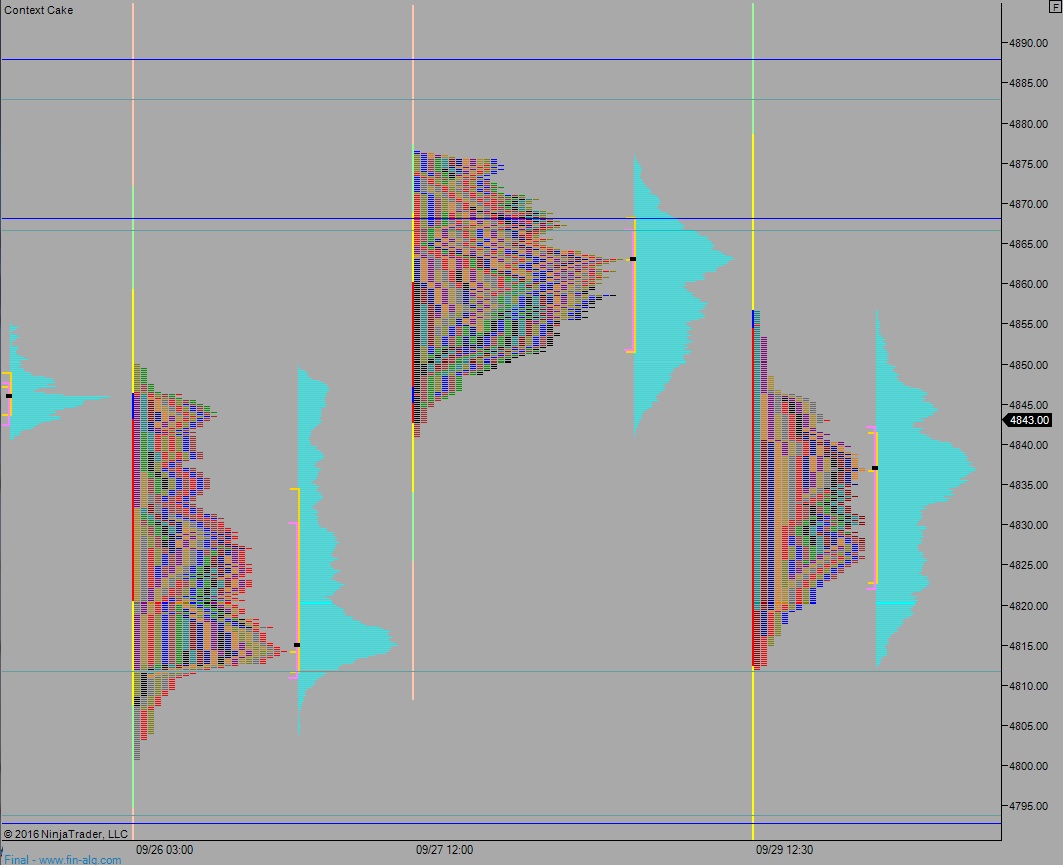

Heading into today my primary expectation is for a fast push down off the open, down to 4823.50 (VAL). From there buyers step in and work up through overnight high 4847.75. Buyers continue higher to target 4866.50 before two way trade ensues.

Hypo 2 buyers push off the open, take out overnight high 4847.75 early on then sustain trade above 4866.50 setting up a move to target the open gap at 4886.50 before two way trade ensues.

Hypo 3 strong sellers push down throguh 4823.50 to take out overnight low 4811.75. Look for responsive buyers down at 4799.75 and two way trade to ensue.

Hypo 4, full on window dressing, push up through current swing high 4892.25 to tag the 4900 century mark. Look for sellers up at 4907.

Levels:

Volume profiles, gaps, and measured moves: