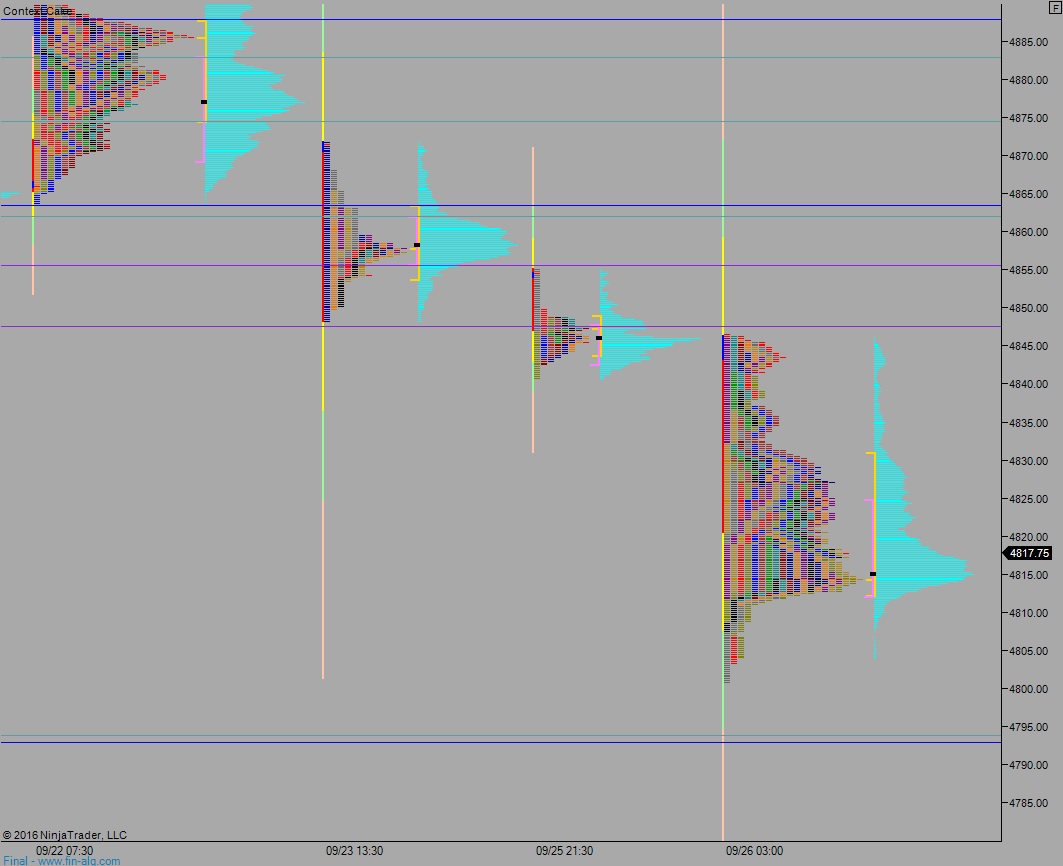

Futures on the NASDAQ are coming into Tuesday flat after an overnight session featuring elevated range on normal volume. Price worked down through the Monday low briefly before finding a strong bid right at the MCVPOC that formed throughout late-September at 4801.50. Buyers pushed up through the entire Monday range before eventually stalling out just ahead of Friday’s session low. Price then fell back down into the Monday range ahead of cash open.

There are several economic events today, all low-medium impact. At 9am the Case-Shiller Composite 20, at 9:45am the Markit Service/Composite PMI, at 10am Consumer Confidence, at 11:30am a 4-week T-bill auction, and at 1pm a 5-Year Note auction.

Yesterday we printed a neutral day. Price opened gap down and after an early drive lower buyers stepped in and pushed the market range extension up. Buyers could not close the gap down into the week, however, before price began working to a new session low before ultimately coming into balance.

Heading into today my primary expectation is for choppy trade that works lower. There is a market profile ledge at 4812 that price spills over and we work down through overnight low 4800.75 to target 4799.75 before two way trade ensues.

Hypo 2 the chop gives way to higher prices. Sellers cannot push the market down through 4812. Instead we work higher, up to 4837 before two way trade ensues.

Hypo 3 strong buyers push up through 4837 and take out overnight high 4846.50 setting up a move to target the open gap up at 4858 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter