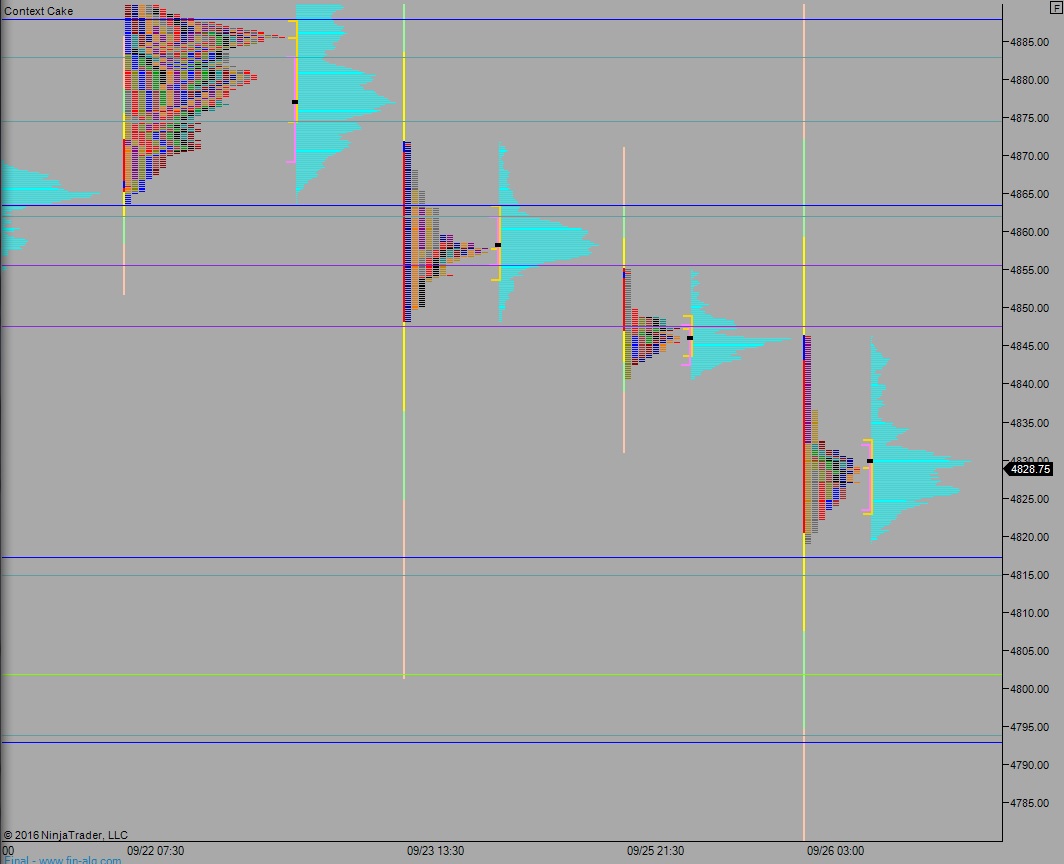

NASDAQ futures are coming into Monday gap down after an overnight session featuring elevated range on normal volume. Price worked lower to test the topside of a value the market formed before the FOMC rate decision last Wednesday. Buyers showed up and defended the region.

On the economic calendar today we have New Home Sales at 10am, 3- and 6-month T-bill auctions at 11:30am, and a 2-year Note auction at 1pm.

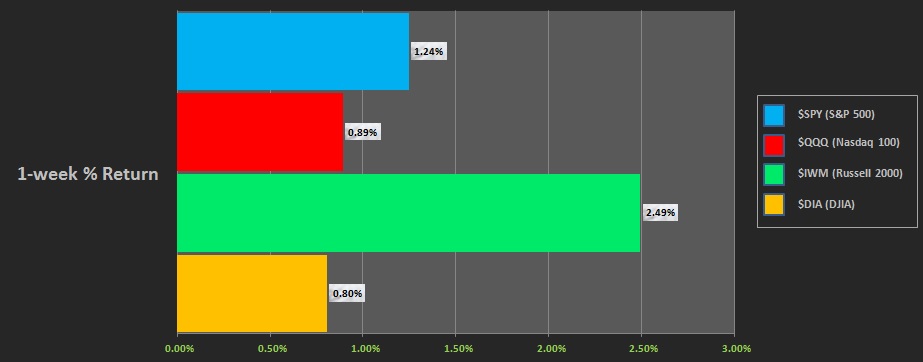

Last week began choppy but ultimately gave way to buying after the Federal Reserve left their key borrowing rate unchanged. All markets but the Russell 2000 made new swing highs post-FOMC. However, the Russell was the best performing index on the week. Below is the return of each major index last week:

Last Friday the NASDAQ opened gap down and after failing to regain the Thursday range it pushed lower to close the Wenesday/Thursday gap, ultimately printed a neutral extreme down.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade back to Friday’s low 4848.25. Sellers reject a move back into the range and two way trade ensues.

Hypo 2 buyers push a full gap fill up to 4858 then take out overnight high 4859.50. Look for sellers up at 4862.25 and two-way trade to ensue.

Hypo 3 sellers gap and go lower, take out overnight low 4819. Buyers show up around 4815 and two way trade ensues.

Hypo 4 full-on liquidation, down below 4815 to target the MCVPOC at 4801.50.

Levels:

Volume profiles, gaps, and measured moves: