NASDAQ futures are coming into mid-week trade gap up after an overnight session featuring normal range and volume. Price worked higher overnight, to a fresh swing high which probed late-December 2015 price levels, following an earnings beat from Microsoft just after closing bell.

See also: Evil $MSFT Posts A Solid, Albeit Boring, Quarter

On the economic docket today we have crude oil inventories at 10:30am.

Yesterday we printed a normal variation down. It was a slow, balanced tape that drifted lower after coming into the day gap up. During settlement price spiked higher following Microsoft earnings.

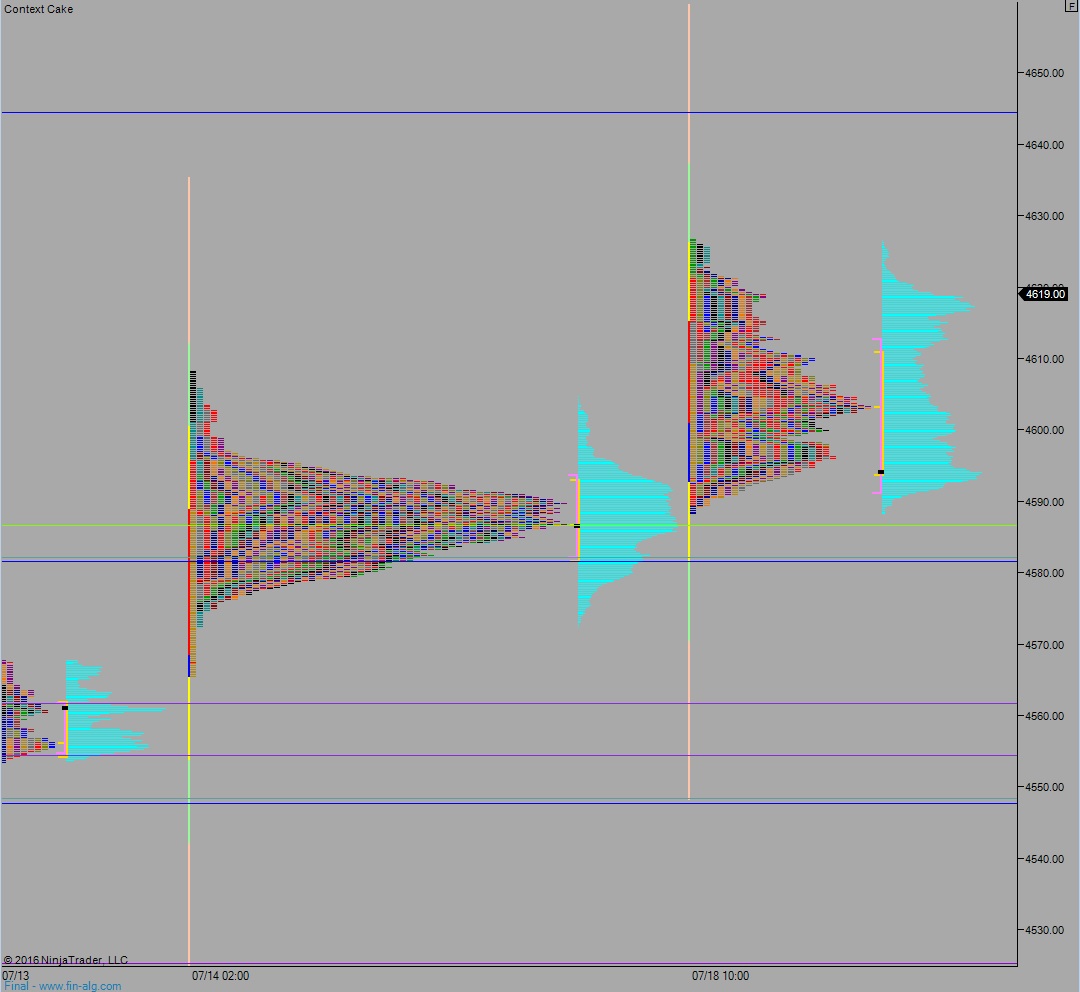

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4605. From here sellers continue working price lower, down though overnight low 4597.75. Look for responsive bidders down around 4586.50 and two way trade to ensue.

Hypo 2 buyers gap-and-go, take out overnight high 4626.75 early on and continue exploring higher prices. Look for responsive sellers up at 4630.50 and two way trade to ensue.

Hypo 3 buyers blast up-and-out of the ascending wedge forming on the daily chart, up through overnight high 4626.75 and sustain trade above 4630.50 setting up a secondary leg higher to target the open gap up at 4645.50 before two way trade ensues.

Hypo 4 strong selling closes overnight gap 4605, take out overnight low 4597.75 and breaks down through 4580 triggering a liquidation down to the open gap at 4561 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: