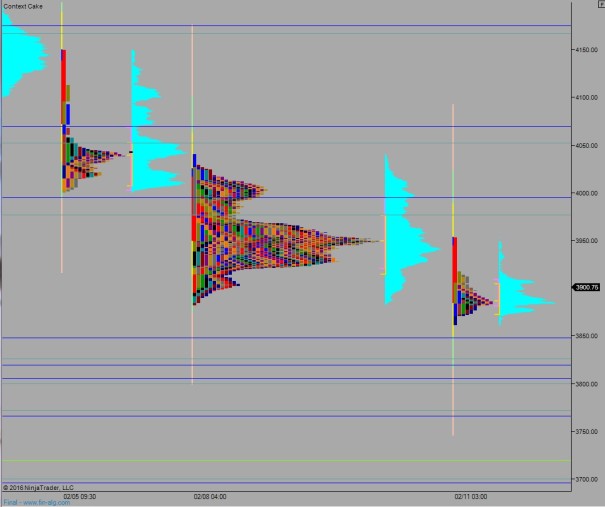

NASDAQ futures are coming into Thursday gap down after an extreme overnight session, both in range and volume. Price spent most of the session working lower until finding a responsive bid around 7am. Buyers were found just below the open gap left behind on 10/20/2014. At 8:30am Initial/Continuing Jobless Claims data came out better than expected. The initial reaction is buying.

Also on the economic calendar today we have Fed Chair Janet Yellen’s testimony before the Senate Banking Committee. Expectation is for a continued rhetoric that does not strike a dovish tone. We also have a 30-Year Bond auction at 1pm.

Yesterday we printed a neutral extreme down. Price started the day gap up, and after a morning of buying and a brief range extension up, a sharp excess high formed and price worked lower to close near session low.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 3925 before responsive sellers step in (responsive relative to the open, initiative relative to yesterday close). Sellers then work to take out overnight low 3862.25. Look for responsive buyers at 3848.50 and two way trade ensues.

Hypo 2 buyers push up through 3951.75 (yesterday low) and sustain trade inside of it, setting up a move to target overnight high 3971.75. Look for responsive sellers up at 3977.25 and two way trade ensues.

Hypo 3 gap and go lower. Take out 3872 early and sustain trade below it setting up a move to target 3862.25. Buyers put up a brief defense at 3848.50 but are ultimately overrun as sellers target 3825.25.

Levels:

Jesus christ; Yellen is like the bubonic plague of the market

she needs to be courrrected