Nasdaq futures are up a touch as we head into the last day of trade this week. Tomorrow the US markets are closed in observation of Independence Day. Range overnight managed to push a touch beyond first sigma on normal volume.

At 8:30am the NFP data was released and mediocre. The stand out stat was a 62.6% drop in labor force participation. The market reactions to the data have overall been subdued. Third reaction hasn’t occurred yet to my eye, perhaps the opening bell will bring it. We also have Factory Orders at 10am and the Baker Hughes Rig Count at 1pm.

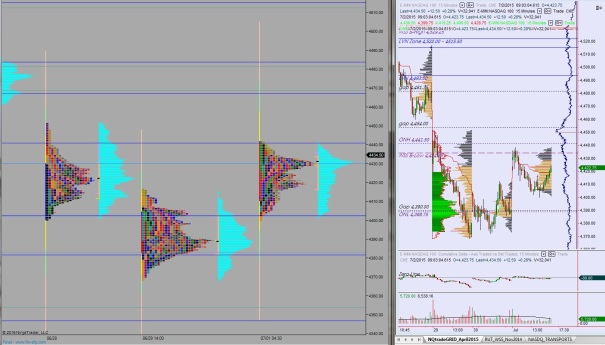

Yesterday we opened pro gap up, the third pro gap on the week, and after an early morning push higher we rolled over and traded back into Tuesday’s range. Sellers weren’t quite able to close the overnight gap before buyers came in and balanced out the session.

Intermediate term we aren’t really going anywhere. Instead we remain range bound.

The overall structure of the current swing low is somewhat troubling. It has a blunt tip on the volume profile which suggests we weren’t quite done doing business lower. We never followed through on the trend day down, and there’s an open gap below.

Heading into today my primary expectation is for sellers to push into the overnight inventory and fill the gap down to 4422.75. Look for buyers around 4415.75 otherwise we continue lower to target the 4400 century mark and close Tuesday’s gap down to 4390.

Hypo 2 buyers hold north of 4415.75 setting up a push higher to take out overnight high 4441.50 and target the open gap at 4454.

If you enjoy the content at iBankCoin, please follow us on Twitter