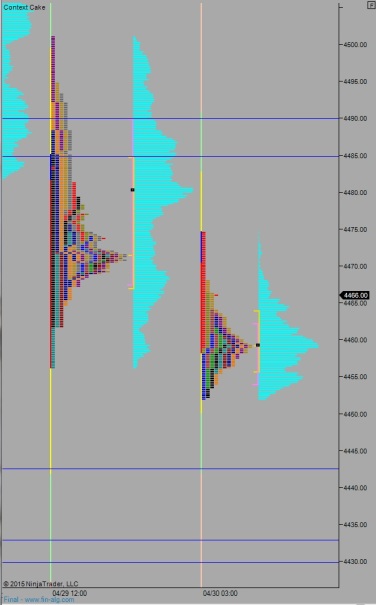

Nasdaq futures are lower overnight. Sellers managed to extend the range just a touch beyond first sigma, doing so on normal volume.

The first thing that jumped out this morning was the overnight profile structure, a lovely lowercase-b check it out:

It was even more pronounced before the 8:30am data. This type of profile suggests a long liquidation took place. A long liquidation is a temporary phenomenon where order flow is created by stops being run. This type of print, in the context of a bigger uptrend, tends to occur at-or-near the inflection point—a welcoming development on the weak week.

Heading into today, my primary expectation is for buyers to fill the overnight gap, pushing trade up to 4478.75. From there we will see if they can take out the overnight high just above at 4479.50. Overall I’m looking for sellers to defend the region from 4485-4490 and two way trade to ensue.

Hypo 2 is buyers push through 4490 and sustain trade above it to set up a leg higher to target Tuesday’s gap up to 4515.50.

Hypo 3 is sellers continue working lower, take out overnight low 4452. Look for responsive buyers at 4442.50 then 4433.

Levels are pictured above.

If you enjoy the content at iBankCoin, please follow us on Twitter