Nasdaq futures are starting the week flat after rallying last week. The overnight session printed normal volume and range but did manage to take out Friday’s session low a few times before bouncing back to unchanged.

The economic calendar is quiet stateside today with Existing Home Sales at 10am as well as Fed’s Williams talking economic outlook. At 1:15pm attention will be on the European Union where Chancellor Merkel is meeting with Greek Prime Minister Tsipras for talks on Greece. They are meeting in Berlin.

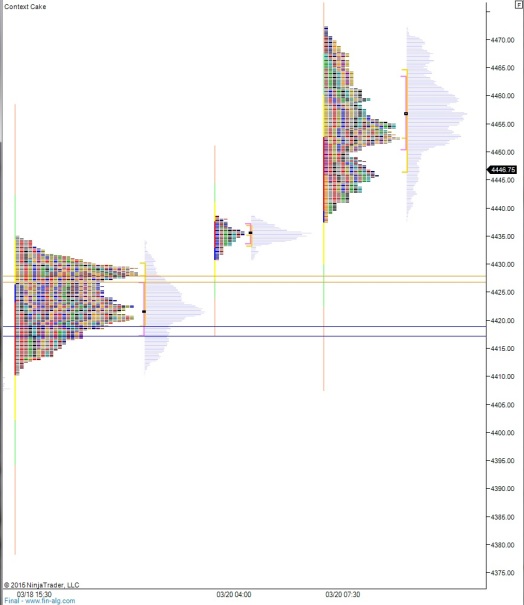

Turning our attention to the charts we can see how the Nasdaq went gap up through a prior well-established value area. Price worked higher for much of Friday’s session before finding responsive sellers 1-tick ahead of closing the gap dating back to March 1st at 4472.50.

4444 serves as a helpful pivot point especially if sellers decide to work into the below gap zone today. Please see below:

Heading into today, my primary expectation is for an open auction inside Friday’s range followed by a push higher to target overnight high 4461.25. If buyers sustain trade above 4459 then look for a push to new swing high 4477.

Hypo 2 is sellers contain trade below 4448.25 and work down into the gap zone below to target overnight low 4439, Thursday’s range gap 4432.50 and a full gap fill to 4424.50. The ultimate target of this hypo is tagging the NVPOC at 4422.25.

Hypo 3 is aggressive selling takes us down through the NVPOC at 4417 and begins working down into the Fed rally. Look for signs of responsive buying down at 4400 but be cautious of a full take back down to 4355.25.

I have highlighted key market profile zones below:

If you enjoy the content at iBankCoin, please follow us on Twitter