Nasdaq futures traded a balanced session overnight before running higher at 7am on news of an extension to the Greek bailout. It is important to note when a move was news driven as the market tends to ‘check back’ to the originating point of the move to ensure it still garners the same type of reaction.

Volume and range are normal on the session and the economic calendar is quiet today. Fed’s Lacker has been talking since 8:20am and we have Wholesale Inventories at 10am. This may result in a choppy, 2-way open as we wait for the news shortly after the bell.

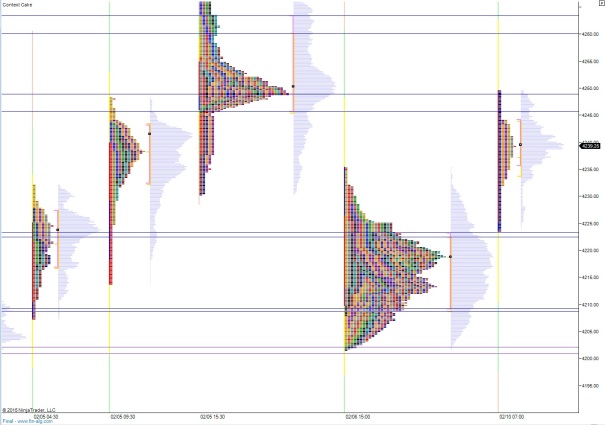

The intermediate term is neutral dating back to late October. We had a strong up move last week, and yesterday we printed a neutral day after starting the week gap down. Responsive buyers were found inside of last Wednesday’s range.

Heading into the open with a ‘pro gap’ up, my early expectation is for an open auction outside range open type which attempts to reenter Monday’s range at 4232 and more importantly the crime scene at 4225. Hypo 1 is buyers step in ahead of Monday’s range and press higher to target Friday’s NVPOC at 4249.50 then work toward retesting Friday’s high 4268.25

Hypo 2, we penetrate the range then I will be expecting a tag of the VPOC at 4219.25 then a full gap fill to 4215.50.

Hypo 3 is a drive down gap fill to 4215.50 and continue lower through Monday’s low 4201.75 and push to test the MCLVN at 4198.50 and a stretch target of 4189.

These levels are highlighted below:

If you enjoy the content at iBankCoin, please follow us on Twitter

third time a charm on 4268?..spot on w the hypo today

indeud