Volume and range expanded to 2nd sigma overnight suggesting the session was slightly abnormal. It started off with a secondary completion wave after the market experienced an encompassing wave of selling at the end of the trading session. The secondary wave pushed through overnight and exceeded yesterday’s low and pushed deep into Tuesday’s range—trading down through the volume pocket we printed on that day before finding strong responsive buying.

Once the auction reversed higher it continued doing so, nearly uninterrupted, up to now, where we are trading about 20 points higher from yesterday’s close. At 5am Fed’s Rosengren was giving an early bird lecture on Sovereign Risk (apropos), at 7am the Bank of England rate decision and Asset Purchase Target numbers came out inline (brought buyers into the NQ), at 8:30am we had Initial/Continuing Jobless Claims and Trade Balance. At 10:30am we have Natural Gas Storage change stats for January.

Prices are higher over a 2-3 day stretch after oversold conditions. We are trading on the high end of a 7-day value range. We are also trading just below the gap zone from 01/26 (last Monday) but we have not yet closed the range gap. Yesterday was a neutral day with a double volume distribution. Intermediate term we are neutral-to-slight-bullish.

My primary expectation this morning is for sellers to push into the overnight inventory and try to fill this gap down to 4204.25. The volume pocket from 4220 to 4209.50 will be an interesting reference point for gauging their success. If they can push down to 4214.75 my expectation is elevated that they will trek all the way through to 4209.50 and a gap fill to 4209.25 where we find responsive buyers.

Hypo 2 is a balanced 2-way open with buyers defending the volume pocket ~4220 setting up for a test of the crime scene at 4242. If they do not find responsive selling then take out yesterday’s high 4243 and work up to the range gap 4246 then a stretch target of full gap fill 4269.25.

Hypo 3 is we grind slowly into yesterday’s volume pocket (4220 – 4209.50) and spend much of the session “filling it in” with 2-way chop.

These levels are highlighted below:

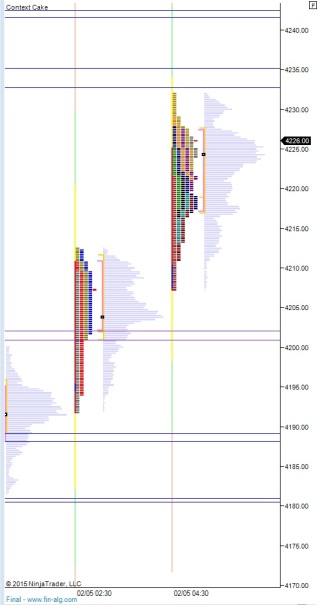

And here are the current market profiles:

If you enjoy the content at iBankCoin, please follow us on Twitter

Twitter.

that’s my birdy, earnings on deck

seeing that EoD move in this context is pretty insane…

I hope you’re mind is swirling with thoughts you may have previously never considered 🙂

HYPO 1 then it mutated into Hypo 2 and now I am essentially done for the day. That was beautiful