Nasdaq futures are higher overnight on a slow-grind type session of trade. As we head into cash open sellers are recapturing some of the progress. The gap up to start the week has been a common feature the last several weeks; a common feature which gives way to selling. Whether that continues to be the case this week will be interesting to observe. Range is on the high end of normal for a globex session and volumes are running in the 2nd sigma.

At 10am we have the NAHB Hosing Market Index as well as Fed’s Powell speaking. The housing data may carry an elevated impact on market prices after the weak showing from the Residential Construction industry last week. Several of the premarket earnings came in well. After hours, two of the majors we will hear from are IBM and NFLX. We also have a Presidential State of the Union Address set for 9pm. More housing stats are set for release in the premarket tomorrow.

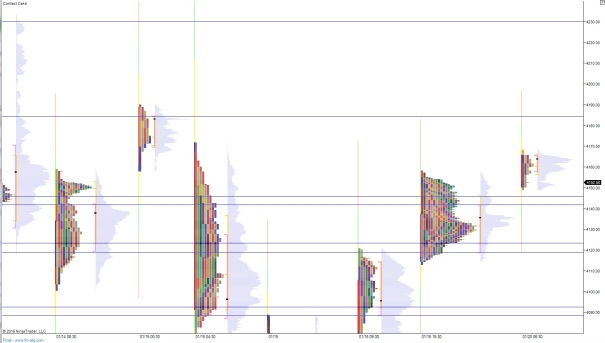

Prices are trading inside a big area of acceptance currently, the microcomposite VPOC sits right at 4144.50. These high-volume areas tend to produce murky, choppy trading action. On either edge of this value we have volume pockets which are where the greater opportunity for trend-like behavior resides. Overall, the intermediate term timeframe is neutral-to-bearish. See below:

Short term we are gap up with some magnets below. Early on my expectation is for sellers to push into the overnight inventory and take us back to the MCVPOC at 4144.50 and continue lower to close the open gap down to 4134.75. I will look for signs of responsive sellers here (responsive relative to the overnight session, initiative relative the Friday) who work toward taking out the overnight high 4168.

Hypo 2 is buyers enter aggressive early and take out overnight high 4168.25 and continue higher to 4184 and possibly trend through that area.

Hypo 3 is sellers close the overnight gap 4134.75 and continue lower to 4120 area. I have highlighted these areas on the following market profile chart:

Pick three, three my lord!

🙂 it was, but the energy when we went range extension down was geriatric, no interest, set the tone for this slow grind up, might end up neutral here soon, lot of day left