Nasdaq futures traded in a quiet range for most of the globex session before selling stepped up around 8am. Since 8am there has been a steady flow of sell orders which paused only briefly ahead of the 8:30am durable goods order release. Overall we are priced to gap down at the open of US trade. Just after the open we will have PMI numbers at 9:45am, natural gas storage data at 10:30am, Kansas City Fed Manufacturing Activity at 11am, and Fed’s Lockhart speaks at 1:20pm. Bank of England Carney is speaking as we head into US trade and the main talking point is interest rates which he says are close to rising.

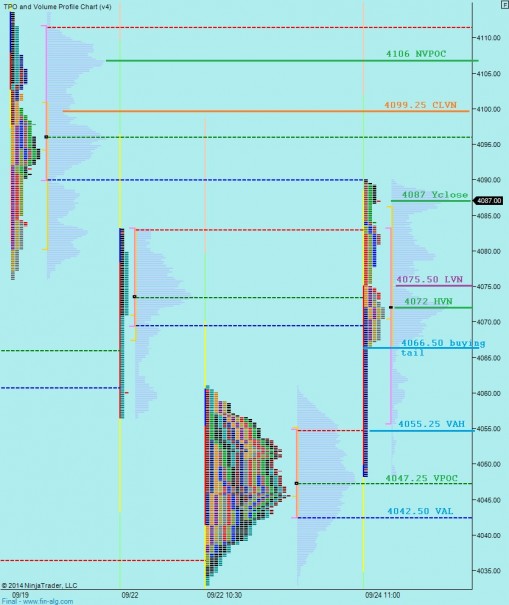

The intermediate term timeframe continued its balancing act yesterday when it quickly traversed the point of control at 4066. The velocity of the move might be attributed to the compression which took place prior to the breakout. When balance begins to form inside of a larger balance, you know there is a coil ready to spring a big move. Buyers will want to defend their progress and extend upon it soon, otherwise they risk calling the entire move into question. I have noted the key levels I will be observing on the following volume profile chart:

On the below market profile chart, I have made some cuts and merges to best view the auction taking place. Note the solid structure below our current prices. This is comprised of trade from late Monday morning through to early yesterday. On either side of it is the hard sell on Monday’s open and the fast buy yesterday. I have noted the key short term levels I will be observing as well:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypothesis – buyers on the open up to 4079.50 where we stall a bit and mush lower to take out overnight low 4072.75 and test buying tail at 4066.50 who work to close overnight gap 4087 and if they take out yesterday HOD 4090 then they target 4100 century mark

Hypo 2 – sellers push off the open, put us below buying tail at 4066.50 which triggers a fast move to 4055.25 where we find responsive buyers who push us back up through 4066 and target HVN 4072. If buyers can push up through 4075.50 then look for a gap fill to 4087 and test of 4090 HOD

Hypo 3 – Price pushes a bit lower and ‘sticks’ to MCVPOC at 4066 and grinds out a tight session

hypo one in a slightly different order so far

OMG. That was fast and crazy.

2 days up, 20 minutes down

No offense.. emotions got out quickly. Now things are calming. Just picked a long trade and that’s my chosen side.

purple underwear today, huh?

they were blue

you are going to need a bigger chart…

lol

that’s rarely a good sign, the MP chart is built on average up/down day ranges which, by the looks of today’s 60 point initial balance, today is anything BUT normal

GoPro +80 now. Gluu is going very well too..

I sold at 71.50