The overnight session was quiet as we head into a busy end-of-week. The NASDAQ printed a below normal 9 point range ahead of CPI, which served to expand the range a bit after a lower than expected increase in CPI was released. Overall, the range is still tight as we approach cash trade.

On these Wednesdays where we have FOMC announcements in the afternoon, we tend to see one or two actionable moves very early in the session and then a pause as the markets waits for the new information to release. Anything can happen, of course, but having a hypothesis or expectation for the early trade means if something else happens we are seeing unique behavior which warrants our attention.

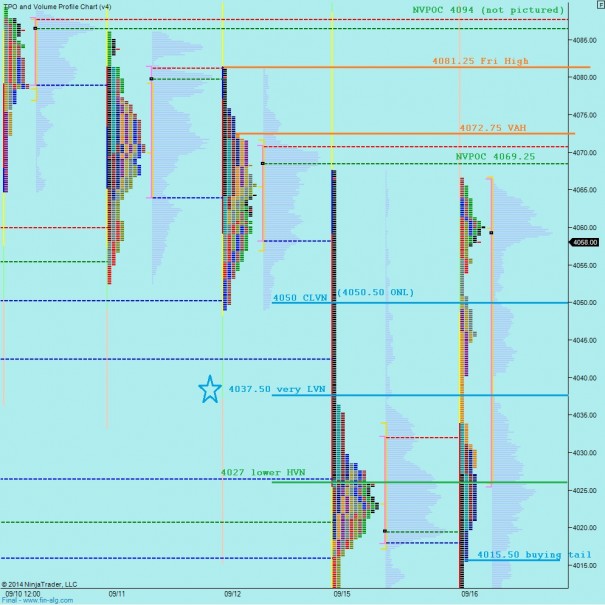

I opened the topic of intermediate term balance to the open forum Sunday afternoon because its starting point was a bit grey at the time. Consensus was 08/25 seemed a proper start date and with that information the downside imbalance became abundantly clear. The fast move lower and subsequent retracement higher yesterday settled the imbalance, but they also stretched out intermediate term balance. Now I have pulled in data going back to 08/18 which gives the lower half of balance a bit more information. Yesterday confirmed our hypothesis that intermediate term we remain in balance when we revised back to the mean at 4066. I have noted the key intermediate term levels below:

I have noted the key price levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypothesis – buyers push off the open, we trade higher and test MCVPOC 4066 and then a failed breakout above 4070 puts us in a churn around 4060 ahead of the Fed

Hypo 2 – sellers push through the thin structure below and take out overnight low 4050.50 and test 4050 CLVN where we find responsive buying up to overnight gap fill 4058 and churn ahead of the Fed meeting at 2:00pm

Hypo 3- buyers show conviction off the open, sustain trade above MCVPOC 4066 and make a move toward Friday high 4081.25

Hypo 4 – sellers drive lower off the open, take out ONL 4050.50 and CLVN 4050 and continue lower to test out 4037.50 where we find a responsive buyer who is subsequently run over for a target of lower HVN 4027 ahead of the Fed