Yesterday I reached out to some of my fellow traders for their thoughts on a somewhat grey area of interpretation on the intermediate term timeframe—where did it begin? By vote, it was determined the start date of our current intermediate term balance was 08/25, the Monday after a glitch at the CME resulted in a delayed start to trade Sunday evening. Changing the volume profile to start at this session makes a significant change to the picture we see of market behavior.

If we opt to use 08/22 instead, the current volume profile is in near-perfect balance, and quiet environment where one could aggressively pursue breakouts in individual stocks. But instead using 08/25, the downside imbalance becomes evident and suggests a bit more patience is likely to yield better entry points at the least. I have noted the intermediate term imbalance below:

The only other way for the above profile to redevelop balance would be to blunt out on the topside via a multiday grind above the mid.

All of this analysis of past market behavior might be long history come Wednesday when we are set to hear lots of information about The Fed and their QE pace. These types of news events as close as you will see to a guaranteed market move. It makes sense to keep this context in mind this week, especially if the market starts grinding sideways, then we are definitely pausing until more information is made available. This week is also option expiration for the front month index future contract as well as many other contracts. We might see an early move because of this. Just before the bell today at 9:15 we have some industrial production numbers which might start the futures moving ahead of the bell.

The overnight session got off to a bumpy start last night. When trade opened in globex a wave of selling ripped through. The volume on the move was very low and the price action erratic as if a few algos were playing ping pong. The net result is a fairly normal 30.75 point range on volume which is slightly above normal.

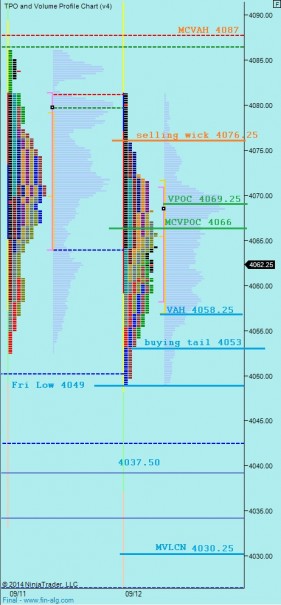

I have highlighted the key levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Very cool followup. Raul, you’ve given me something to watch for this week. BTW, did you see the cryptic message Chess was trying to send us yesterday? http://ibankcoin.com/chessnwine/2014/09/14/analyzing-the-food-chain/

lol, good eye UB

Nice write up Raul. I appreciate the info.

glad to hear 🙂 trade’em well today

Primary hypo – sellers push off the open to fill overnight gap to 4062.25 and then test higher to VPOC 4069.25 before more selling takes us down to test VAL 4058.25 then buying tail at 4053. If buyers cannot defend then continue testing lower to Friday low 4049 and then expand our intermediate term range lower to 4037.50

Hypo 2 – buyers continue their overnight push and thrust up through VPOC 4069.25 and continue higher to test selling wick 4076.25 where we find responsive sellers who work to close the overnight gap down to 4062.25 and then a possible test of VAL 4058.25

Hypo 3 – sustain trade near VPOC at 4069.25 and then build acceptance in the selling wick ~ 4076.25 to set up a thrust higher to 4087

Hypo 4 – drive down, reject out of Friday’s range early, losing low at 4049 to set up a move to MCLVN at 4030.25

Thanks for the follow-up and analysis. Add one additional macro variable for this week, namely the effect that the Scottish independence vote may have on the UKP, and, by extension, the rest of the currency markets.

when is that vote going down?

that thing where your primary hypo is completed in 30 minutes and you never had a chance to participate whatsoever

LOL!

Wow, so right. Bravo! Very interested in how things are going to close today..NQ is a short for a while in my opinion. oh well, could be wrong.