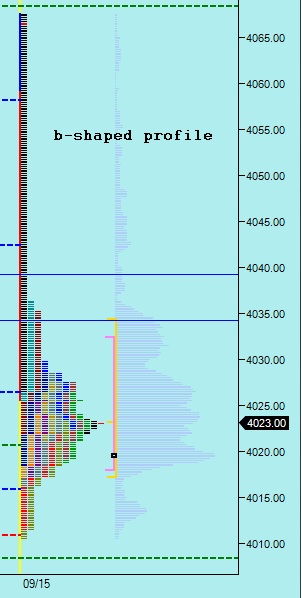

What we just observed today was the rarely discussed counterparty to the short squeeze. My friends, this is what a long liquidation looks like:

This is a temporary market phenomenon where an aggressive other timeframe enters the market early causing an elongated profile. However, instead of continuing to trend for the rest of the session, the market instead comes into balance. When this day type occurs in the context of a downtrend, there is not much you can take away from it—you just know longs were liquidated which is part and parcel to a downtrend. However, inside the context of an uptrend, this day type often serves as a pressure release valve which blows off some steam (tosses a few pikers into the furnace) before continuing higher. Today’s also featured a responsive buying tail, thus the bulls have a few contextual pieces to hang their hat upon.

The extension lower traveled a bit further than I expected, which elevated my concern a bit. I might have missed an opportunity to buy some cheap charts, but part of me wanted to wait and see tomorrow before taking any action. The kicker is Wednesday. There is literally USA QE pace on the agenda for mid-Wednesday trade. You would be a damn fool to not expect price movement on the news. No matter the nature of the news, because I am not one of those analysts, there will be a reaction, and then a reaction to the reaction, and then we likely will have a pretty clear picture of how the next few days of trade will play out. This is big league price action going into the end of Q3. The price action this week is way above my pay grade. I will wait for these big waves to woosh through the market place, apply auction logic to the footprints, make an educated guess about the next 2-3 days, position accordingly, and manage risk to make the money.

In summary, today we printed a b-shape profile. These are temporary phenomena, especially during an uptrend. We have been in intermediate term balance for 16-sessions, why break it before the BIGGEST ASSED piece of information is introduced Wednesday afternoon? And I may not be aggressive enough, opting to not add risk today.

However, I have enough risk to tide me over, so don’t worry about your old pal Raul. I was down about 6% today.

If you enjoy the content at iBankCoin, please follow us on Twitter

Raul, spectacular post, man. What a week to blog market profile!!

thank you, and, indeud

I had a few longs I was eyeballing also but couldn’t get myself to hit “confirm send”.

a pause to slow your roll until this week’s economic events play out makes sense

nice commentary….and I’m positioned 115% long, so hope you’re right, otherwise it will be another 6% down tomorrow.

stay thirsty my friend, review you plan, trade your plan, accept all external events, now at this very moment

I’m told you’ll be in Vegas next month. Good luck to you with the conference.

Am I to understand the great Mr. Cain Thaler will not be in attendance? 🙁

Raul, what do you do for a living?

you’re looking at it, bub

Outstanding Raul3…outstanding..

thanks