Futures in the Nasdaq are a touch lower overnight on a drift down overnight. During this rollfoward period, where some traders opt to move into the December contract whiles others stick around and trade the September contract, most of my volume studies are rendered less useful. However, the session appears to have occurred on fairly normal volume. We had Advance Retail Sales numbers premarket which were in line with expectations for the month of August. On the docket during the trading session is U. of Michigan Confidence at 9:55am and Business Inventories at 10am.

As we wrap the week, take a look at the big picture, via a weekly chart of the actual Nasdaq composite index. After racing through a gap left behind 14 years ago during the dot com bubble bursting, we are now holding steady along the upper edge of the gap. This long-term timeframe is buyer controlled and we can see responsive buyers on attempts to take price back down through the gap. Keep in mind, however, this type of activity, responding to lower prices multiple times, expends the buyers resources and energy. Whether this resolves via another leg higher or an exhaustive buyer giving the gap back is unknown, but the context is interesting nonetheless:

On a more actionable timeframe, the intermediate term, we can see balance maturing to now 15 sessions. If you are a swing trader who buys quality chart setups, you couldn’t care less if this index stayed in balance indefinitely. What is curious about balance on the index is “where” it occurs and “how” it allows individual names to behave. When we spend weeks slugging out balance down in a trough, individual stocks can be punishing, win rates on the long side lower and less robust, and short sellers gaining a slight edge. However, up at a peak, individual names can breakout and stick as we have seen recently. With that in mind, and depending on how you trade, it is pertinent that you understand the boundaries of this balance and where value is. Your job is to buy below value and sell above value until this environment resolves itself. Also we need to be on the lookout for a value shift and who it entices into the marketplace. I have noted the key levels on the intermediate term timeframe below:

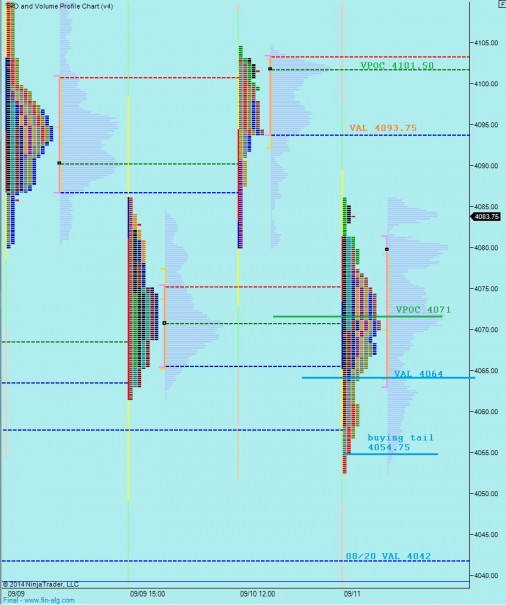

I have noted the short term levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter