Nasdaq futures are flat overnight after printing a very wide and fast range yesterday. The spike in volatility yesterday coincided with the Apple product release. As the event introduced new technologies, the price of AAPL stock was radically swinging, moving the Nasdaq alongside it. The economic calendar is quiet for today’s session, however there are a few pieces of context to keep in mind.

First, tomorrow is the Thursday before OPEX, a day often reserved for shenanigans. Second, China released their CPI and PPI data after hours tonight which might impact any Chinese holdings currently housed in your book.

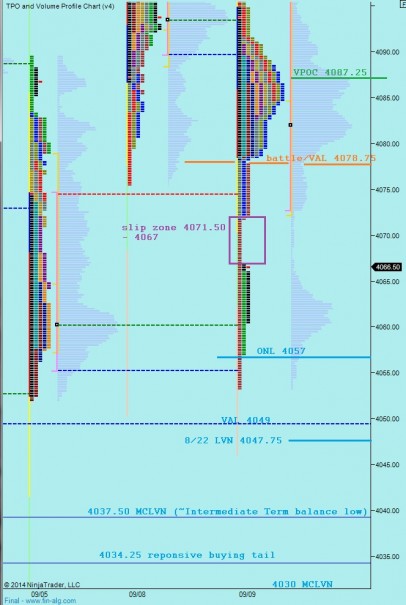

Turning our attention to the auction, we can see the intermediate term still hangs in balance. The fast action was enough to raise a few eyebrows, especially how we rejected fresh swing highs, but we do remain in balance overall on this timeframe. This balance is best seen using a volume profile which encompasses the last 13 sessions. I have built this profile and noted the key price levels below:

Yesterday I made several comments about 4080. The reason was how price was behaving at this level. Sellers made three aggressive pushes at 4080 which were absorbed by a buyer, presumably the same responsive buyer who existed on Monday in this territory. The problem was, like any aggressive attack on a territory, it jeopardized the structure in that area. Said in market profile terminology, by mid morning we had a very blunt “poor low” which was susceptible to breakage. It eventually did break, we found a sharp responsive buy to new multi-year swing highs, at this point going neutral (expecting the fade back to the mean), before finally giving way to heavy sell flow for a proper mean revision on the intermediate term time frame. On the net, yesterday was seller controlled and we printed a neutral extreme profile. This makes hypothesizing very simple today.

I have noted the key price levels I will be observing today on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypothesis – sellers push off the open, take out overnight low 4057 and test VAL 4049. If no responsive buyers are present then continue lower to test 4047.75 and perhaps the lower extreme of balance at 4037.50. Otherwise if we do find responsive buyers then look for a move up to 4066.50 and then through the slip zone 4067-4071.50

Hypo 2 – buyers push off the open, through the slip zone 4067 -4071.50, take out overnight high 4073.50 and test the battle line at 4078.75 where responsive sellers take us back down through the slip zone and make a move toward overnight low 4057

Hypo 3 – buyers take the slip zone 4067 -4071.50 then break the battle line at 4078.50 and find acceptance above 4080

Hypo 4 – drive down, take out ONL 4057 and VAL 4049 early, breach intermediate term balance to test MCLVN at 4030

right up the slip zone, day traders, you HAVE to love these slip zones

right back down the slip zone, day traders, your day could be done if you play that right

back up through the slip zone, lol

now a 4th move through the slip zone, OTF presence, caution in this chop

back to the 80s . NQ is leading by all means. What’s your opinion on divergence with ES, TF in general?