Nasdaq futures are up just a bit as we approach the open of US trade. We are current priced to open inside of yesterday’s value

The economic calendar is picking up steam as we head into the final days of the week. Premarket we saw jobless claims come in a bit better than expected and the news encouraged sellers a bit. We have manufacturing PMI coming out at 9:45am followed by Existing Home Sales and Philadelphia Fed at 10am. However, participants are particularly concerned with the tone of Fed’s Yellen talk set for 10am Friday.

The intermediate term continued being under the control of buyers yesterday where we saw sluggish upside action but continued upside action nonetheless. We saw our first signs of some real seller interest yesterday after hearing minutes from the FOMC. The Fed minutes were greeted with a 10 point rotation down, the largest selling rotation of the week. The question however, especially if you intentions are to initiate a short sale, is are we done finding sellers? I have noted the key price zones I would expect sellers to begin recapturing if we indeed have finished this intermediate term leg higher:

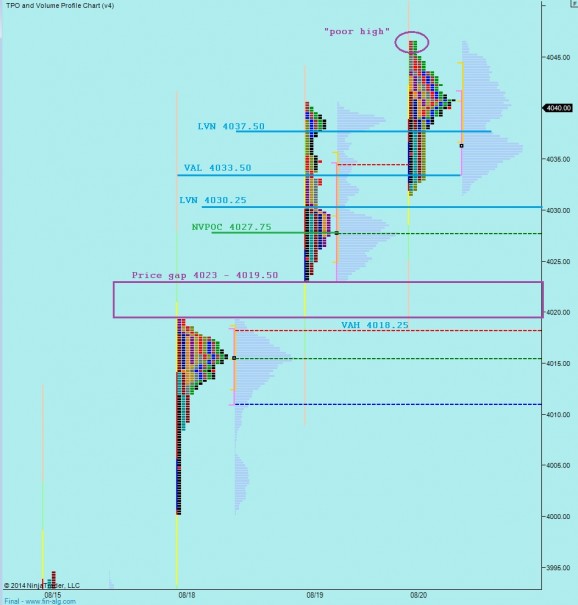

The daily market profile suggested a bit of indecision on the day after wrapping up as a neutral print. Neutral prints tend to occur at or near inflection points. This was a very sluggish neutral print and it left one slight hint that we may not be done going higher. Before the session was wrapped up we printed a poor high. Overnight prices came up and poked the level again. I have highlighted this observation, as well as other key price levels I will be observing on the following market profile chart:

Primary hypothesis – sellers test lower off the open, fill the overnight gap to 4040 and down to LVN 4037.50 where we find responsive buyers who take out the poor high/overnight high at 4046.50. Measured move target = 4048.75

Hypo 2 – sellers push down through the LVN at 4037.50 to target yesterday’s VPOC at 4036.25 and test down to VAL 4033.50 where we find responsive buyers. If they can push back above LVN at 4037.50 then a move above the poor high/overnight high at 4046.50, otherwise a second rotation down to test the LVN at 4030.25

Hypo 3 – strong seller drive off the open, push out of yesterday’s range early to test the NVPOC at 4027.75, not much of a buying response and we continue lower into the price gap from 4023 – 4019.50 and test the VAH at 4018.25 for responsive buying

Hypo 4 – strong buying drive, take out overnight high 4046.50 early and press through measured move target at 4048.75 to continue exploring higher for a conviction seller

hypo 2?

hypo 2 yes, sellers had a chance for hypo 3 at one point but lost the mid