The upside discovery process taking place this week is being led by the Nasdaq. Perhaps this is the reason why I have been successful this time around—I study the Nasdaq like an obsessed stalker. There is an industrial reason why the Nasdaq is out performing both The Russell and the S&P. The index is not bogged down by the lagging financials. Did you know that? The fact that no financials are housed in the Nasdaq is one of those little details that no one really emphasizes but is important to know.

You should never assume a detail to be too minuet, especially if it furthers your knowledge of a pursuit. If you already knew this about the Nasdaq, GOOD, let’s move on…

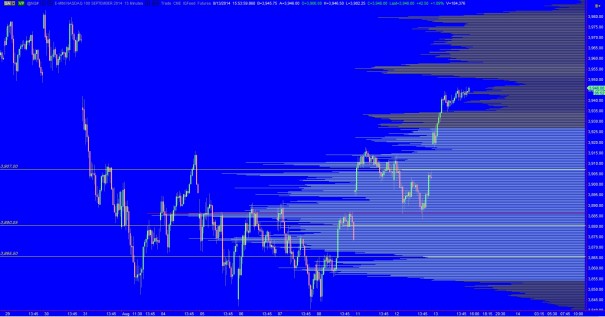

Volume pockets, we love them. Those unaware of their existence and location chalk up vertical moves to news events at best and often times other mental masturbation like manipulation or galactic alignments. We are trading inside a thin volume pocket today after over a week, about 9 sessions, of serious compression. This pocket is likely to be traversed a few times, but right now the order flow favors longs.

My actions on this blog are for the explicit purpose underlying the ethos of this fine web domain, gregarious winship for the betterment of learning traders worldwide. I used to pander for approval, panhandling for your votes and such, but since have focused on what I am doing and why I choose to do it and how it furthers my goal of being a champion trader. I knew some of you might struggle holding risk through the weekend but that is exactly what needed to happen to have a sweet entry into this move that is currently underway.

All of that value compression last week built the energy needed to fuel this move. The only question you should be asking yourself going forward is, “Is the market done finding sellers?” Think about that question, find ways to answer it. Look at the way a high is formed, for example. Look at where the market is trading relative to the price action on our left and formulate an idea. Then stick to it, you don’t need me or anyone else to be happy–you need a plan.

On the day I scaled off a few wins, bought some DDD next week calls and added some time to my bust WUBA long.

I see no reason to be overly concerned about this Nasdaq move yet, it hasn’t even pulled back yet. We have no frame of reference until it does so, IMO. We take this one day at a time. And if financials decide to join the party, those C calls I bought yesterday are looking nice.

Stay sharp, alert but not tense.

If you enjoy the content at iBankCoin, please follow us on Twitter

Hot and fresh out the kitchen.