Nasdaq futures caught a bit of a pop this morning right around the time European Central Bank released their rate decision which continues to be in line with expectation. About half of the fast gains have since been given back, and the sell flow began at 8:30am when ECB’s Draghi began his press conference. At the same time US Continuing and Initial Jobless Claims were released. Continuing Claims were worse than expected and Initial Claims better. The rest of the economic docket is open today aside from a 10:30am Natural Gas report energy traders will want to keep an eye on and Consumer Credit at 3pm.

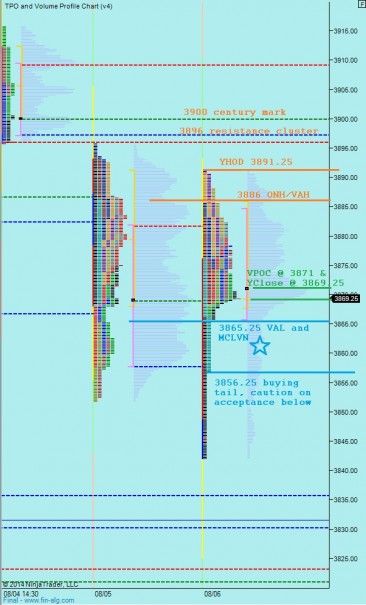

The intermediate term timeframe is flirting with the idea of going seller controlled. We are almost developing a pattern of lower highs and lower lows. To negate this developing process, buyers need to step up and establish a higher high very soon. If they can hold the LVN at 3865.25 it would be a productive start to the process. Even if they cannot press up and out today or tomorrow, by simply slowing the action down they would fortify the idea that intermediate term balance is still in place. I have highlighted key intermediate term price levels below:

Buyers are still on their heels, and without stabilization soon we risk another acceleration of price discovery lower. The question I constantly ask when the market is working on building a swing low is, “Is the market done finding buyers?” We saw a sharp responsive buyer off the open yesterday morning and the action saw continuation into the afternoon—initiative buying coming in after the fact. Once a strong bid is established, this is what we see, the action process goes in the other direction until it is done searching out a seller. The process forms value. If the conviction buyer does not show up to defend her responsive buying yesterday morning, that could be a shift in short term sentiment. I have highlighted the key price levels I will be monitoring early on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypo – sellers push off the open into the overnight long inventory to test VPOC at 3871 and possibly fill overnight gap down to 3869.25 where we find responsive buying up to take out overnight high at 3886 and test yesterday’s high 3891.25. If price accepts above yest HOD then make a run for the century mark at 3900

Hypo 2 – buyers press early, take out overnight high at 3886 but stall out before yesterday’s HOD 3891.25 due to responsive selling. Rotate down to test VPOC at 3871 and balance out above yesterday’s close 3869.25

Hypo 3 – gap-and-go drive, drive through yesterday’s high and make an early run at the 3900 century mark where some responsive selling is found but we ultimately accept prices above 3900 and make another leg higher to 3906.75

hypo 2 so far

There’s that seller – let me take all your momentum muahahahah!

What’s your overall take on this battle?

“Great fear is concealed under daring.” – Lucan

that seller at MCVPOC 3886 is very daring, likely scared, if we hold yesterday’s afternoon swing low on the /NQ_F, it’s looking quite a bit like the tail end of discouragement.

Acceptance above 3883 puts a ton of pressure on this seller. A close below 3865.25 makes me leary, and I may begin covering below 3856.25 because those prices could likely negate the strong bid we found down there yesterday morning

how damaging is a weak close?

I am assessing it as we speak, may lighten up a thing or two, only hesitance I have is this excess low we printed

Looking forward to tomorrow’s post – thanks!

This move in wfm phasing you? Regreting not taking advantage of uncle carl the other day, thinking I’m out below 36.4

not really phasing me, might have been fancy to profit off that rumor and re-enter, but that was never my plan, I gave myself until September to achieve a higher target