Index futures are down quite a bit across the board as we approach the final day of US trade in the month of July. The major news overnight came from Argentina, who in a few hour may default, an event which would “plunge the country into turmoil.” Worsening tensions with Russia seem to be weighing in on the eurozone where some are speculating the external shock may be enough to push them into a deflation trap. We are off the overnight lows a bit but saw a fresh wave of selling roll in after the 8:30am US Continuing Claims and Initial Jobless Claims. We have Chicago Purchasing Manager at 9:45am, a Natural Gas Storage report at 10:30am, and Chinese Manufacturing PMI out after hours today at 9pm. We are also in the thick of earnings season which has been mixed but positive for social media, a hot spot of discussion after being singled out by Fed Chair Yellen.

We can rack our minds with all of this macro economic news, or we can focus our energy and attention on the auction taking place, and use our objective eye to perceive who is participating in this market, what they are trying to do, how good of a job they are doing, and what they are likely to do from here.

It is the end of the month, equity inflows typically take place at the start of a new month, and we are wrapping up the first month of Q3. The first half of the year was a challenge for growth performance, especially after many of the marquee high beta stocks were cut in half. Thus starting the second half of the year strong was important to many participants. With that in mind, we know the intermediate term is very likely to be active in this environment.

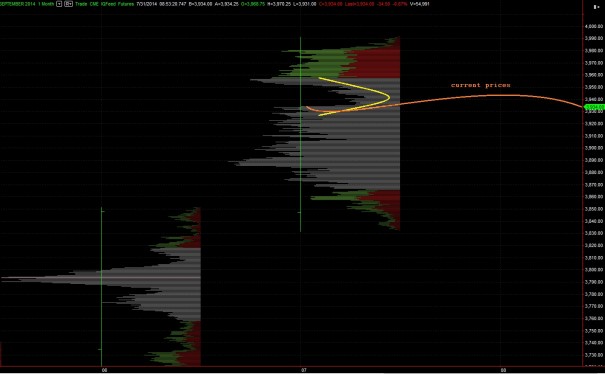

On the month, we formed a rather balanced profile until launching higher. The final footprint left a big volume pocket which we have slid through overnight. There was a second volume pocket up higher, but we filled it in this week. Now it appears we are backing and filling this region. See below:

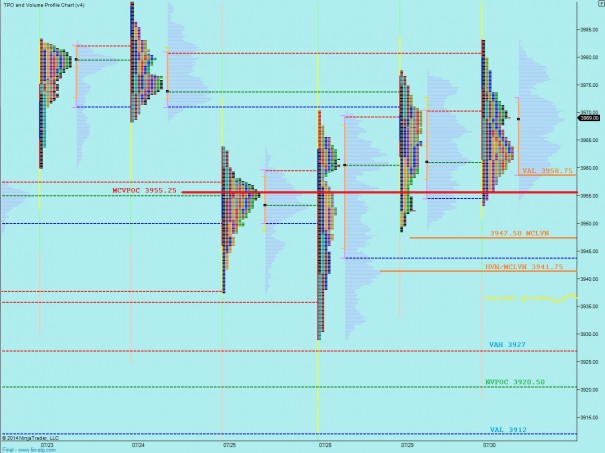

If I bring our eyes in a bit closer we can see the key price levels on the intermediate term, the levels we are likely to see respected during today’s trade:

I will also be keying off the following market profile levels to start the morning:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – sellers push off the open to take out overnight low 3931 and test the VAH at 3927 where we find responsive buying up to MCLVN at 3941.75 where we see sellers attempt another push to target the NVPOC at 3920.50

Hypo 2 – responsive buying off the open which rejects overnight gap and reverses up through 3941.75 and 3947.50 to target the MCVPOC at 3955.25 and perhaps test the VAL at 3958.75 before finding responsive selling

Hypo 3 – drive down off the open, gap-and-go liquidation, take out ONL 3931 then a quick push down to NVPOC at 3920.50 and down to 3912 VAL before finding some responsive buying, but ultimately giving way to another wave of selling

Hypo 4 – buyers push off the open into the overnight short inventory, test the MCLVN at 3947.50 before finding some responsive selling. Price settles inside the volume pocket and balances inside of it to back-and-fill between 3950 and 3935