Nasdaq futures are up a few points on the globex session after a quiet morning on the economic front. Whether or not Hari Raya Puasa sees lower volume than a normal session is something to consider today. We also have PMI Service flash at 9:45, Pending Home Sales Index at 10, and Dallas Fed at 10:30.

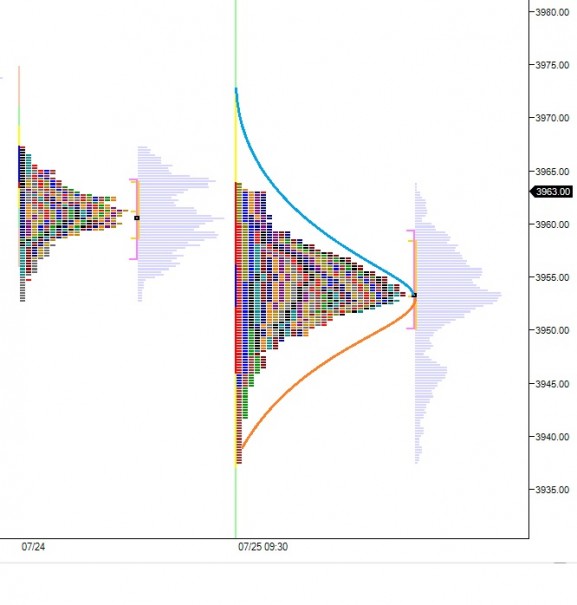

The overnight session saw a few large rotations in both directions, but the brunt of the action was seen pushing higher. The index put in a fairly durable low around 7pm before exploring higher into the early morning. We are now lingering up near the high of the session as the USA comes online. The net globex profile has a slight skew which could resolve itself in a few ways, see below:

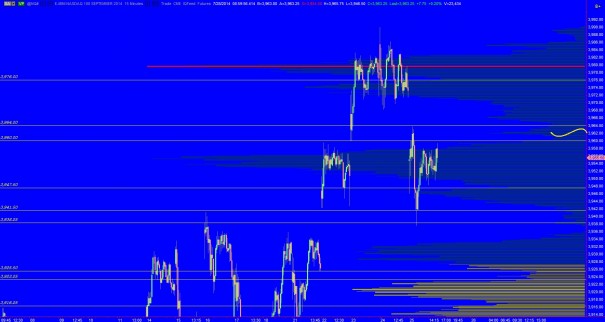

We started to break intermediate term balance last week and explore higher. However it seems the market is trying to not allow this, and as a result the intermediate term has become a bit of a mess. This is actually a good thing, it affirms the idea of an out of balance marketplace and provides some very prominent low volume nodes as signposts as we trade. However, if the intermediate term participants continue their activity this week, then we might see an uptick in volatility. I have highlighted the key nodes below:

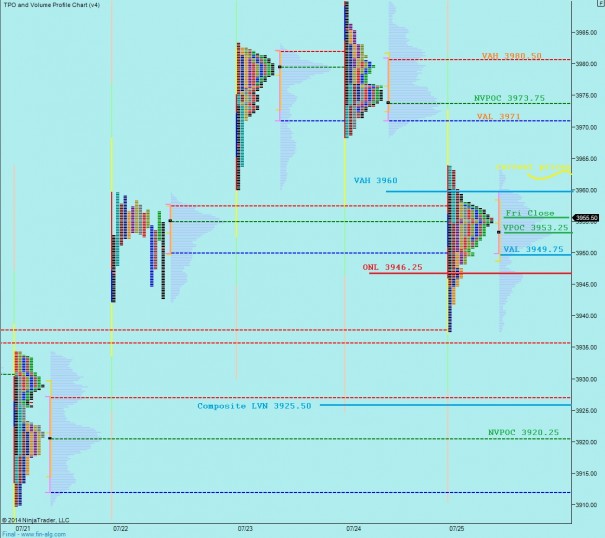

On the below market profile chart, I present the levels I will be watching as we start the week:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – sellers push off the open to close the overnight gap down to 3955.50, perhaps testing VPOC at 3953.25 before finding responsive buying to test upper balance at 3971 with a target of the NVPOC at 3973.75

Hypo 2 – buyers initiate buys into the gap up and push through the VAL at 3971 and through to the other side of balance to 3980.50 before finding responsive selling back down to VAL @ 3960 to target the overnight gap fill to 3955.50 and possibly a test of Fri VAL @ 3949.75

Hypo 3 – strong open rejection reversal by sellers who push us through Friday’s range early and open the door up to a intermediate term push lower through the pocket below to test down to the composite LVN at 3925.50 and potentially target the NVPOC at 3920.25

Hypo 4 – gap and go drive higher, take out upper distribution early and sustain trade above 3980.50 before continuing higher

follow up from post on ChessNWines blog this past week.

added to ARO here:

Status Filled at $3.1497

Symbol ARO

Description AEROPOSTALE

Action Buy

Trade Type Cash

Market Session Standard

Order Date 07/28/2014, 10:35:10 AM ET

why? because I can, Partridge..

Damn if you are not always on top of your game(?) The antagonistic little pickr pal.. ..hahah!! Keep humoring me, won’t you(utter sarcasm)? What effin joke..

I’ve hardly posted all summer here at IBC and BAM..

*such a coward in lieu of response via ST ..

let it fly so I can hop on here and tell you to go F#*% yourself..

Sure hope you are all having a wonderful summer..

Have a great day all you Beautiful People.

😉

Oh, by the way, congratulations to the bears. I’m talking about those that actually have a position short.It’s been a nice trade..