Nasdaq futures are clawing back some of their losses this morning but are still priced to gap down at the open of US trade. One of the bigger headlines overnight was a press release from President Obama. This hit the wires around 5:45pm yesterday, however the real sell flow did not kick in until early this morning. On the net we printed a 30 point range during the globex session. On today’s economic docket we have the Philadelphia Fed at 10am and Google and IBM reporting their earnings after hours.

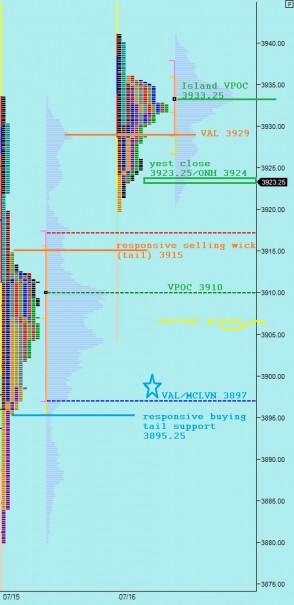

The interesting feature of price action coming into today is the “island” of prices left behind by this gap lower today. We gapped up yesterday and held the gap in a rather blasé round of summer grind. Under the surface momentum names were mixed but certainly not advancing. By gapping lower today we have completely abandoned the prices we printed yesterday, including a fresh swing high early in the day. The result is a day of trade with gaps on both sides, an island, a somewhat uncommon feature.

On the intermediate term timeframe, we can see trade clearly continues to be balanced. We have a clean bell curve with a solid VPOC right near the mid. We are currently priced to open somewhere near the upper half of value and we have some interesting price levels in play early on. Sellers may want to press down into the other side of value to search for a quality bid, to make sure the buyers are still possess the conviction to perceive prices below our VPOC as discounted and an opportunity to make some money. It would also flush out some weak hands. However, if the lower boundary of value gives way, we may be in store for a full on liquidation. I have highlighted these levels and others below:

When you zoom into the market profile, we can see prices are trading inside of Tuesday’s range, a WIDE range established during Fed Chair Janet Yellen’s semiannual Senate hearing. This value area is fairly established, thus I consider its levels significant. If we spent more than an hour trading inside this range, then my expectation is for us to traverse the entire value area. Otherwise, we may reject out of it with some responsive buying back to yesterday’s range. Either way, it is a great piece of context to monitor today. I have highlighted the key levels I will be watching on the following market profile chart:

hypo 1 – push higher on responsive buying vs overnight inventory, test responsive selling wick at 3915, find responsive sellers, take out overnight low 3894 then test the VAL 3897 before balancing out inside of Tuesday’s range

hypo 2 – drive up through selling wick from 3915 up to yesterday’s close 3924, then rotate up to VAL 3929 and if through then likely target island VPOC at 3933.25

hypo 3 – fill overnight gap up to 3923.25 and find responsive buying back down to Tuesday VPOC at 3910 before ultimate rotating down for a test of VAL 3897