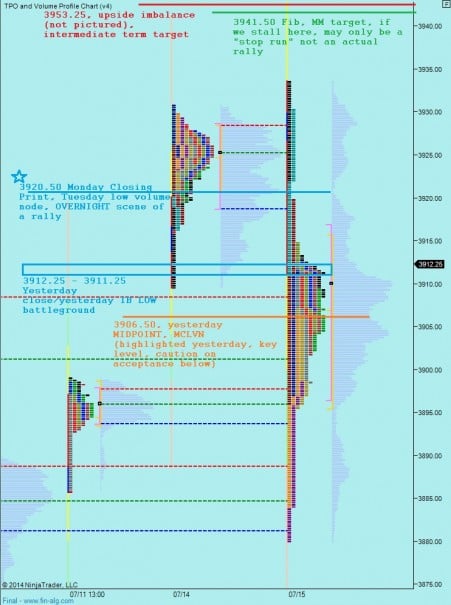

The intermediate term timeframe continues to tell the story at the Nasdaq, as the developing region of balance hits its marks methodically like the German soccer club. Yesterday’s action played right into the thesis of intermediate term balance but also added a piece of credence to the expectation for additional upside. If you recall the intermediate term chart from yesterday, we had nearly symmetrical “tails” on either end of the Gaussian volume distribution, the bell curve. I suggested our upper tail needed just about five points to mark pure symmetry and balance. This mark happened to line up with a Fibonacci extension, which is not magic—I use the level to see if we are merely running stops before reversing or if the move is an authentic departure from balance. Yesterday it was running stops before we settled out the troubling overnight gaps, beautiful. Even more beautiful was the test of our well-established VPOC. Price tends to overshoot VPOCs a bit, especially when we are coming in HOT like yesterday. Nevertheless, buyers responded to the midpoint of balance with a force equivalent to the sellers and buying took hold. Late into the session was saw initiating buyers coming in, pressing us above WHAT WAS the boundary between intermediate term value and the upper tail. WAS, because all the volume transacted yesterday morphed value higher and created an intermediate term imbalance—an imbalance we seem to be settling premarket. This very long paragraph settles the question, “What has the market done?” See below:

On the economic front, PPI stats came in better than expected across the board and we are seeing a muted response from the equity indices, however gold hit new highs on the session with the news. Fed Chair Yellen was speaking to the Senate yesterday, a semi-annual ritual where the head of USA’s central bank must withstand a barrage of questioning from a panel of Senators. She did not flinch, and toward the end had to go to bat for big banks and they must be pleased with how well she defended against the stern spoken final two Senators. These two tough-guys (they were actually women) were clearly saved for the end, and came in with very aggressive “bad-cop” tones, battering the likes of JPM and GS. Yellen crushed the entire situation with poise. Today at 10am she is back in the hot seat, this time to face the more simpleton House Committee. We also have Industrial Production at 9:15, but the market moves more on the Fed than anything else.

Early on I will likely be selling some of the leverage I put into my book during yesterday’s dip. Otherwise I will be keen on the price action at the following price levels to guide my trade into the second half of this week:

If you enjoy the content at iBankCoin, please follow us on Twitter

hypo 1 – responsive selling to overnight strength, targeting test of 3920.50 where buyers are seen responding and pressing higher to imbalance target of 3953.25

hypo 2 – press lower, through 3920.50 and target gap fill down to 3912.50

hypo 3 – drive higher off the open, targeting imbalance target of 3953.25

We are back to 3920-sih – I guess it is show time

hypo 1 hypo 1

I wonder how that short is working out for Mr. P..at under $11..(now up over +50%..from St. Paddy’s day bash)

‘AA’lluminati..alright!

ahh..yes..

f/d: I do hold a nice size position stating accum. of share with last ins at that time^..yup!

thinking of taking a bit of profit here(?)

I’ll keep you posted..

😉

So we are essentially where we started the day with volume above and below