Nasdaq futures are up a touch after ceding some of their gains as we approach cash open. There were no major economic releases this morning aside from Canadian unemployment data with the main items on the US docket being Fed’s Charles Plosser speaking at 11:15am and Charles Evans at 2pm. We also receive the Treasury Budget at 2pm.

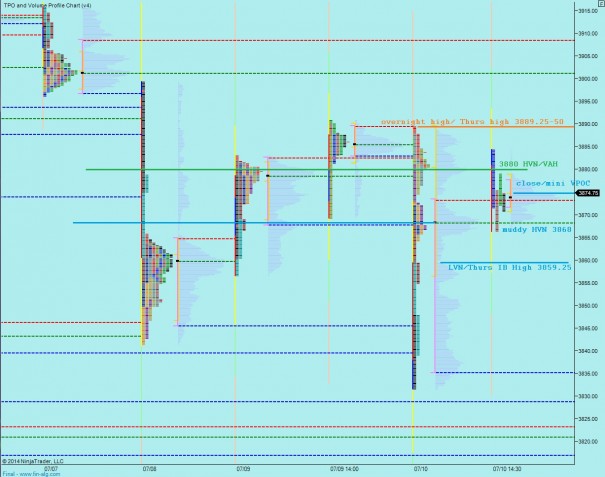

The intermediate term held onto balance, barely, with the big responsive buying gap fill trade yesterday. I have highlighted the very significant price levels to monitor as we progress through today and perhaps early next week, the levels that will give insight into who is jockeying for control of the balance:

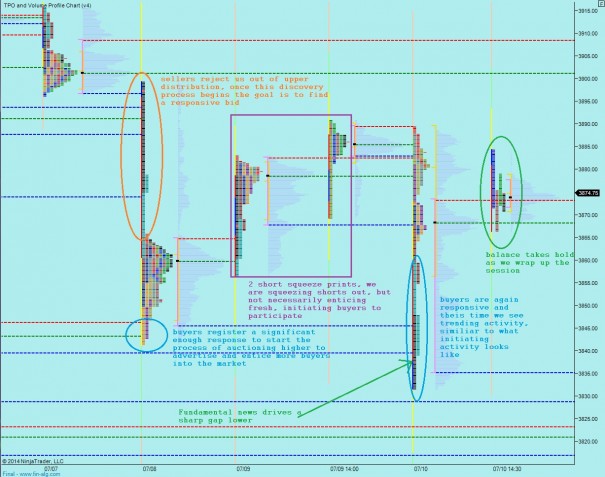

I have walked through the market profile on the following chart to give a sense of what the market has done this week:

What the market is trying to do is find balance on the short term after being jostled out of balance by the big selling early in the week. The question is where we balance and how it fits into the longer timeframes. The balancing process is going well.

I have highlighted the key short term levels on the same market profile chart without the descriptions being in the way:

If you enjoy the content at iBankCoin, please follow us on Twitter

hypo 1 – test higher to LVN @ 3884.25 find responsive sellers, rotate down through “muddy” HVN at 3868 and find responsive buying just below at 3865.25 before balancing out around 3874.

hypo 2 – press lower to overnight gap fill 3874.74, find responsive buying which stalls before LVN at 3884.25 and come into balance around 3880

hypo 3 – drive lower through overnight gap fill 3874.74, through HVN 3868 and test the LVN down at 3859.25 before finding some responsive buying and then continuing to probe lower

hypo 4 – drive higher through overnight high 3889.25 and test MCLVN at 3896.50, if acceptance above, continue driving up

hmmm?

http://ibankcoin.com/flyblog/2014/07/11/fly-buy-ag-2/

taking profit in both EXK (+73.80%)and MUX (+65.94%)here:

Status Filled at $6.17

Symbol EXK

Description ENDEAVOUR SILVER CORP COM NPV ISIN #CA29258Y1034 SEDOL #2980003

Action Sell

Trade Type Cash

Market Session Standard

Order Date 07/11/2014, 03:35:30 PM ET

**continue to hold core position Acquired 12/11/2013 at $3.55 (posted entry)

and..

Status Filled at $3.07

Symbol MUX

Description MCEWEN MINING INC COM USD0.10 ISIN #US58039P1075 SEDOL #B7F06Y9

Action Sell

Trade Type Cash

Market Session Standard

Order Date 07/11/2014, 03:43:25 PM ET

**continue to hold core position Acquired 12/13/2013 at $1.85 (posted entry)

sorry I was unable to post on Fly’s blog..

not worthy, I suppose.

😉

have a great day all you Beautiful People.

probably should read..^

have a great weekend all you Beautiful People..

Seems as if it were just yesterday that it was the”FOURVE OF JURAI”.

Also, hands down agree with Mr. Cain Thaler and Mi. in the summertime. Ahhhh Yes!