The markets constantly shift from a state of balance to imbalance and back into balance. This behavior is a result of the open marketplace and how buyers and sellers come to an agreement on where the value of a security is. The key is knowing which timeframes are in balance, which are not, and who is likely to be participating in the marketplace given the conditions.

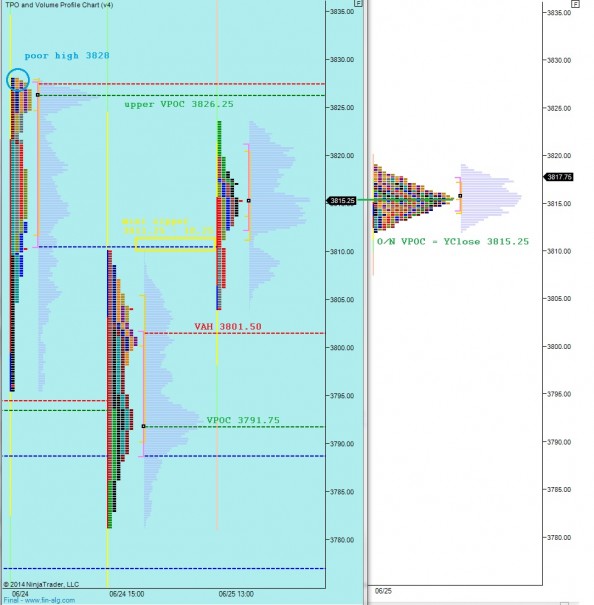

With the Nasdaq trading near annual highs it is reasonable to expect most participants are active in the market to some degree. Right now the intermediate term is out of balance. Even though price re-trended higher yesterday, we never saw value shift higher. In fact, our VPOC stayed pinned back where the prior consolidation was. The price action was impressive from the bulls but they are now tasked with proving their grit by sustaining this move and pressing value higher. I have highlighted some of the interesting intermediate term levels below, including the “crime scene” where the rally-breakdown-rally seems to gather steam:

Short term we are out of balance on the RTH profiles. It takes some chopping to see the auction properly but value is indeed moving higher. Overnight we printed a very balanced session, see below:

US personal spending came in below expectations and consumption expenditures were in line during the 8:30am announcement. We have Fed’s Bullard speaking in New York at 1:05 PM and some afternoon treasury auctions. There is also a natural gas report at 10:30am.

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1 – test lower to overnight VAL 3814 and find responsive buying, take out yest HOD 3823.50 and target upper VPOC at 3826.25 and poor high at 3828

Scenario 2 – push down through o/n VAL 3814 and press through the mini zipper at 3811.25, trade down to 3801.50 and find responsive buying. Balance out near 3810

Scenario 3 – test higher to 3820 selling wick, again find a responsive seller and begin rotations downward to close overnight gap to 3815.25 then down through the mini zipper at 3811.25 and through 3801.50 for a test of 3791.75 VPOC.

Solid analysis as usual!

thanks

Afternoon Hypos:

Scenario 1: rotate down to test LVNs at 3808.25 and 3806.75, find responsive buying and go for HOD

Scenario2: continue pressing higher to 3816.50 and find responsive selling through LVNS at 3808.25 and 3806.75 back to the VPOC at 3799.25