The Nasdaq futures are quiet overnight, up a few points as the financial participants hold their collective breath ahead of this afternoon’s Fed proceedings. The market expects $15B pace in MBS purchases, $20B pace in Treasury purchases, $35B in QE. We also our rate decision (0.25% forecast) and Janet Yellen press conference at 2:30.

With OPEX this Friday, and the Fed itinerary, the rest of this week is not an environment to be complacent in. There is likely to be other timeframe participants through the rest of the week, and knowing the key price levels and observing the market behavior is important for knowing exactly the type of context we are trading in.

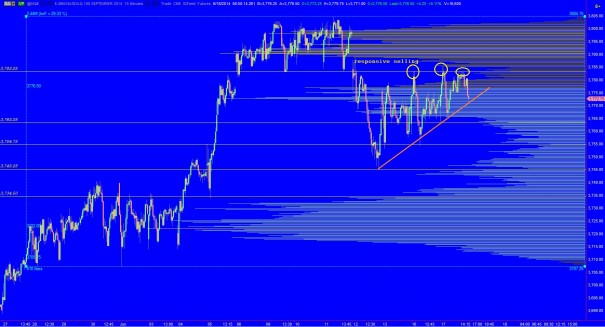

On the intermediate timeframe, we are balanced just below our uppermost distribution. Three attempts have been made to breach the threshold separating our current bracketed trade from the uppermost distribution and each time we have found responsive selling at the resistance. Below, and nearly 40 Nasdaq points away, is a base which formed during the end of May and into June before we rallied. The VPOC of this entire composite still resides in this bottommost distribution and the structure below is thin and toothy. If sellers can initiate order flow below 3754.75, then we are likely to see a test of this base before we go elsewhere in the auction. See below:

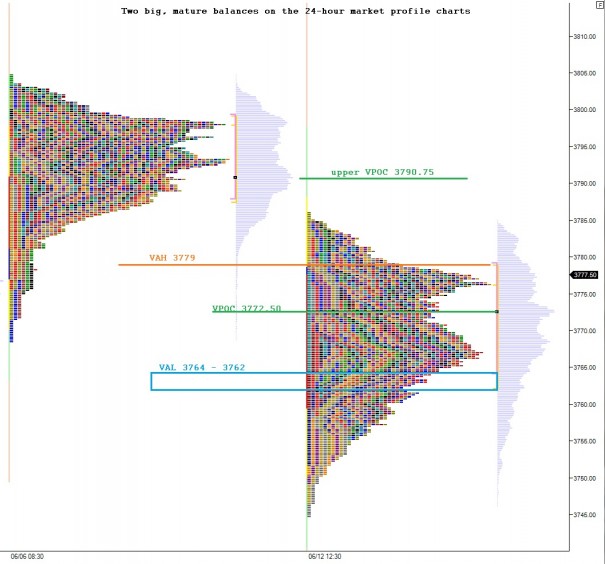

If you look at the 24-hour globex profiles, you can see the long duration of time we have spent in balance. The older these balances become, the more likely it is they break. The key is monitoring the action near the extremes of value and whether we are making a clean break. See below:

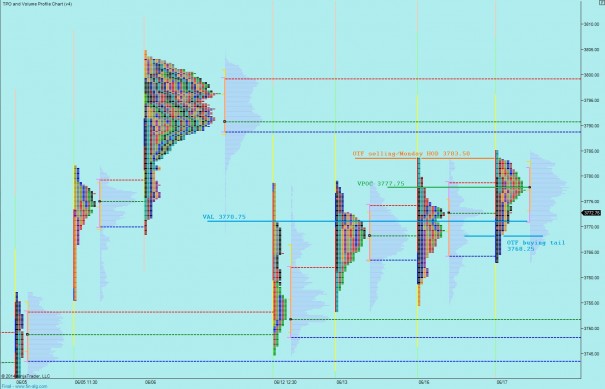

Taking our attention to the short term, we can see value continues to overlap but move higher over the last four distributions. Yesterday’s auction formed a much cleaner distribution than Monday, thus we should monitor today’s action verses the value area that formed. A clean move away from this value may be an early indication of where the market is headed over the coming days. See below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1: test higher, find responsive selling just above yest VPOC 3777.75, press closed the overnight gap at 3772.75 then rotate lower to take out overnight low at 3770.75 and test buying tail at 3768.25

Hypo 2: test higher, find responsive selling at 3783.50, rotate down to fill overnight gap to 3772.75 and balance in yesterday value above 3770.75

Hypo 3: test lower, fill overnight gap 3772.75, find responsive buying at overnight low/VAL 3770.75 and rotate up to test 378.50 and possibly upside target 3788.75

Hypo 4: drive lower, take out buying tail at 3768.25, find a counter rotation at 3763.25 (CLVN), before testing recent lows at 3754.75 (CLVN)