Nasdaq futures opened to a sharp drive lower Sunday evening before finding a bid slightly below our Friday lows. The market then drifted a bit higher for the rest of the session and we are currently priced about 10 handles below Friday close. We have the Empire State Manufacturing Survey at 8:30 which could change prices ahead of the bell. We also have Industrial Production at 9:15 and the Housing Market Index at 10. Overall, the early news flow may create some early opportunities in the market.

Starting with a long term view of the Nasdaq Composite, we can see the market finding sellers after three weeks of exploring outside a well-established bracket. The selling came in right where we might expect, up near prior swing highs. The question this week is whether sellers become more active and begin initiating additional sales after their responsive actions. Below is a chart where each candle represents a week of prices on the Nasdaq Composite:

On the intermediate term, we can see prices are in a state of balance. We are trading between two well-established value zones. The levels we currently inhabit received very little auctioning the first time around as we simply blasted through them. The thin zone can produce fast moves in the short term, but the resolution to this intermediate-term balance will depend on who can initiate trade beyond the strong balance zones on either side of this volume pocket. I did not want to mark too many low volume nodes to obstruct the view of the market here, but I did mark the most pertinent ones for monitoring a transition away from this zone. Three levels are noted below—two low volume nodes near the extremes and on low volume node near the middle (pivot). See below:

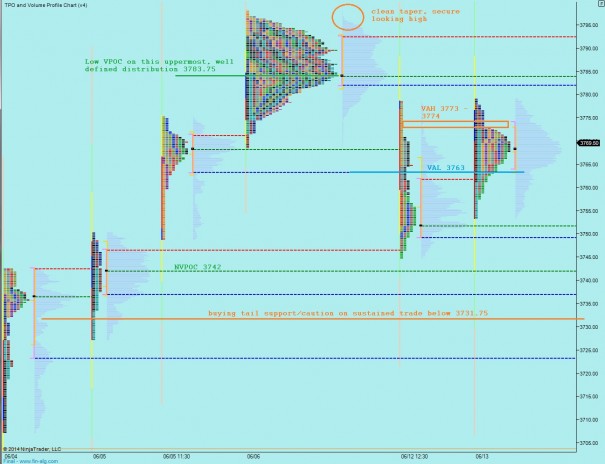

I have noted my key observations of the short term auction below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypothesis 1: test higher to close overnight gap at 3769.50 and test value area high 3773-3774 where we find responsive selling and balance out near VAL 3763

Hypothesis 2: test lower to HVN at 3751.75, rotate up but stall out below VAL 3763, and work toward targeting naked VPOC at 3742

Hypothesis 3: press higher through VAH 3773-3774 , rotate up through Friday’s high and target upper VPOC at 3783.75

A note to Patricia D..a dear pickr friend who peruses this site.

Oh jeez, beyond great to hear your beautiful voice this past weekend and here’s to ISIS this Monday morning.

I could not recall off the top of my head entry/add..so here you go:

05/07/2014 YOU BOUGHT

ISIS ISIS PHARMACEUTICALS

Cash Shares: +* Price: $22.97

**Thanks for that one, my friend.

Nice..