The NASDAQ futures drifted higher over night on low volume ahead of the jobs report at 8:30am. The initial reaction to the jobs report was a move higher. The report itself was mediocre-to-decent news thus an initial positive reaction is good, but not of the strongest conviction. The strongest conviction would be a positive reaction to a bad employment report. The strength was quickly faded by a strong bit of sell flow. It looks like the opening may be interesting today.

The long term time auction is buyer controlled. This can be seen as a series of higher highs and lows on the a daily chart of the NASDAQ composite. If sellers can succeed over the next few days at printing a lower high verses March, we will likely see the long term auction transition into a balanced state.

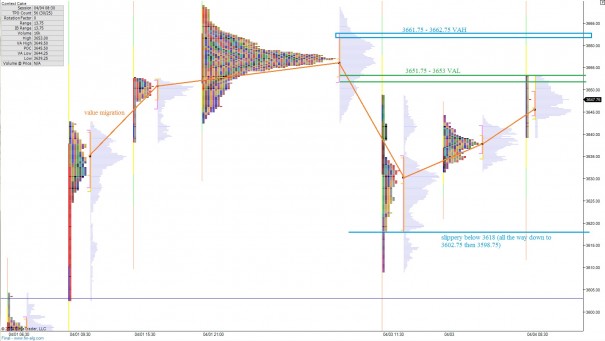

The intermediate term auction is in balance. Overhead supply came into effect yesterday morning and the resulting trading day was a press lower. The action probed prices back to the midpoint of this intermediate term balance where my expectation was to find buying. I will be watching the price action around 3632.75 for an early directional bias on the day. I have highlighted this level and a few other observations on the following volume profile chart:

The short term auction is very indecisive but I would call it a semblance of balance. Value is roaming somewhat aimlessly. We have a strong developed profile overhead which price rejected away from yesterday and since then we have been inching back upward toward the reference zone. I have highlighted this key upside profile as well as a few other observations on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

no bueno

taking first few lots off Transocean here:

Status Filled at $41.96

Symbol RIG

Description TRANSOCEAN LIMITED COM CHF15

Action Sell

Quantity 500 Shares

Trade Type Cash

Market Session Standard

Order Date 04/04/2014, 10:28:54 AM ET

04/04/2014 10:28:57 AM $41.96 51.000 $2,139.91

04/04/2014 10:28:57 AM $41.96 400.000 $16,783.62

04/04/2014 10:29:15 AM $41.96 49.000 $2,055.99

NET TOTAL 500.000 $20,979.52

*continue to hold (below 40 lots)

and plan to add back share if given the opportunity…yup

RVLT is holding the 3 level..thinking of avg up here..

f/d long cost avg $2.50..I’ll keep you posted.

Also.. cost avg up off those 23’s right here(1/3 add back)

Status Filled at $56.93

Symbol FB

Description FACEBOOK INC COM USD0.000006 CL A

Action Buy

Trade Type Cash

Market Session Standard

Order Date 04/04/2014, 12:07:23 PM ET

http://youtu.be/Fi9srqFqCFo

also selling some TZA

Acquired 03/04/2014(not certain if I posted that entry?) crazy that it’s not up higher..inverse nonsesnse?

Status Filled at $16.31

Symbol TZA

Description DIREXION SHS ETF TR DAILY SMALL CAP BEAR 3X SHS NEW

Action Sell

Trade Type Cash

Market Session Standard

Order Date 04/04/2014, 01:09:01 PM ET

*will continue to hold small position Price: $14.3599

Status Filled at $3.02

Symbol RVLT

Description REVOLUTION LTG TECHNOLOGIES INC COM

Action Buy

RVLT doesn’t rip until Sooz is on the bid

Thought $OESX was going to test 8

or was it 6