The first day of the month is statistically favorable to the bulls in both the SPY and the QQQ. People have written entire books about this stat, divulging in great detail all of the first day of the month scenarios and holding periods. One of the findings of the study [spoiler alert!] is when the first day of trade for a new month falls on a Monday, the upside results are greatest. The study also showed a 4 day holding period from the close before month end yields the most favorable results. This is why you likely saw many traders pressing their longs into a cold war weekend.

Thus, to come to market this morning with price trading out of range, out of value from last Friday’s action puts the market dangerously out of balance. We still have an hour and 20 minutes to at least return inside yesterday’s range which would slightly reduce the risk/reward environment, but as it stands we are set to open out of balance.

This presents a unique opportunity situation for the intraday trader. The volatility will allow a disciplined trader to either end their day rather quickly or see several high probability trade setups during the day. Either way, this type of environment gives much quicker feedback as to whether your trade choices are right or wrong. As for existing positions, it makes sense to give more weight to the close than the open. Let the imbalance get slugged out for several hours to allow some signal to show up through the noise.

Context is more important than ever in this environment, as we do not want to lose sight of the big picture. The long term is still controlled by the buyer. This can be seen as a series of higher highs and lows on a daily chart of the NASDAQ composite. Buyer control of the long term was questioned by the market in early February. The outcome was a sharp, snapback rally which affirmed demand to be strong and pressed prices to new highs. A new test of this control would be price trading to 4100 on the $COMPQ index.

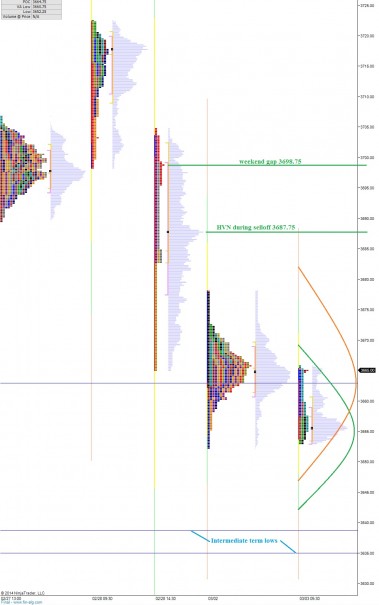

The intermediate term is in balance. This balance spans 75.5 hours of regular trading hours which dates back to the afternoon of 02/13 when we blasted out of prior balance and went exploring higher. A series of higher highs and lows degraded into balance ahead of last Friday where we attempted to move up and out. After a failed auction at the new highs, price aggressively reverted back into the intermediate term balance. After such a move, my expectation is for price to test the lower extreme using the velocity of the failed move to propel us lower. I have highlighted this action as well as some key levels inside balance on the following volume profile chart:

In the short term, sellers are pressing value lower of the last two distributions. Their most recent thrust lower was rejected and a bit of a snack back rally has shown up in the early hours. I have highlighted a few scenarios for this morning, one which sees sellers retaining their grip of the market via being the only active participant (orange) and another potential scenario which sees more balancing occur via a two timeframe marketplace (green). I have highlighted these observations and a few more on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

sword needs to be sharpest today. time to ride out buddy.

Eddie L..holding

(+37.87%) posting entry here on your most fan~tabulous blog

Acquired 02/04/2014

also cost avg down on WPRT here:

Status Filled at $15.26

Symbol WPRT

Description WESTPORT INNOVATIONSINC COM NPV ISIN #CA9609083097 SEDOL #2956811

Action Buy

Quantity **** Shares

Trade Type Cash

Market Session Standard

Order Date 03/03/2014, 09:35:36 AM ET

getting ready for take~off..

this goes out to my kindest pickr friend, kjp, if he happens to be reading.

I think it’s time. jeez, we’ve held this for so long(assuming you still hold share tucked away in your port)

I’m planning a road trip to Ann Arbor and beyond this weekend and will report info here.

For you, Sir Raul, this little spec is gathering momentum but is still a penny stock so therefore I do not want to be accused of being a pump and dumper. I will most certainly keep you posted..

No bull shocka locka, all you Beautiful People..

http://youtu.be/WA-hZd9RgI0

wish I could PM you but I am a twitter quitter(don’t you know?)..d@mn it!

position(unrealized gains) sits at +$29,000.00 +290.00% as I jam out this message(nice size position… with a move today up on just under 3 pennies (.029)

it would be ‘Grand’ if it pulled a NEXS (RVLT)move.

gotta LOVE those kind of gambools!

like all others..SPRT at 50 pennies

NEXS at jeez I think it was 7~10 pennies..

even the latest PEIX..pennies from heaven.

They all did a huge reverse split and soared shortly thereafter.

So my big Fat guess is this, long time in the making, will do the same(?)

I picked up another 50k shares of ILED b/c i like the idea of a patent on “aimed optics” that increases visibility “while providing the highest energy efficiencies available.” They will probably go bankrupt…