Long term directional timeframe remains in the controlling hand of the buyer, who has been successful in their campaign for higher prices. This can be seen as a series of higher highs and higher lows on both the weekly and daily charts of the NASDAQ composite.

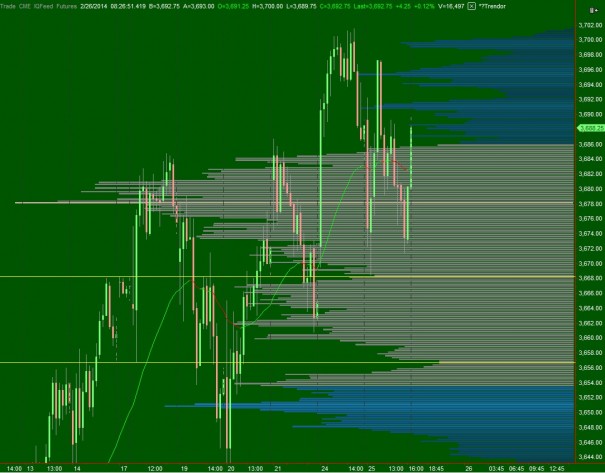

The intermediate term is still balanced. Yesterday we printed a lower high verse Monday’s session, and also a lower low. Interestingly, the lower low was early in the session and was met with strong responsive buying. However, not enough initiating buy flow came to push a new high. Instead we printed a lower high and ultimately a higher low coiling before closing. We can see the market struggling to make a vertical move out of our intermediate term balance on the following volume profile chart. Should the intermediate term control dictate market direction today, we may see sellers targeting yesterday’s low at 3668.25 and then the low volume node at 3656.75. I have highlighted this level on the following volume profile chart:

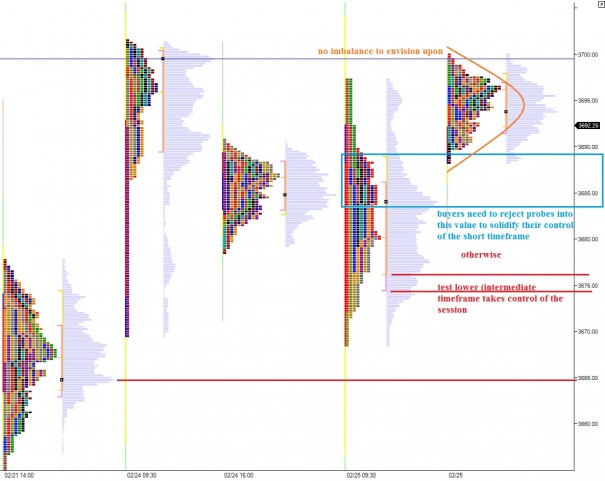

The short term is in buyer control. Yesterday looks like an ugly candle print on a normal bar chart, but when you view the auction that took place via market profile, you can see the buyers were responsive at the lows and their flow was dynamic enough to press prices up out of our distribution. Since then, they have held us above yesterday’s distribution and formed balance [acceptance] in our uppermost distribution. To solidify the buyer control of the short timeframe, buyers need to hold us above yesterday’s value area either by rejecting attempts into the zone, or by avoiding it entirely. I have highlighted this buyer goal on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter