The market drifted higher overnight, with the NASDAQ printing two methodical rotations higher. The action was dynamic enough to press price outside of yesterday’s value, but static enough to keep prices within yesterday’s range. Thus the risk/reward level is elevated today, but not National Homeland Security Red by any means. It’s more like a code orange.

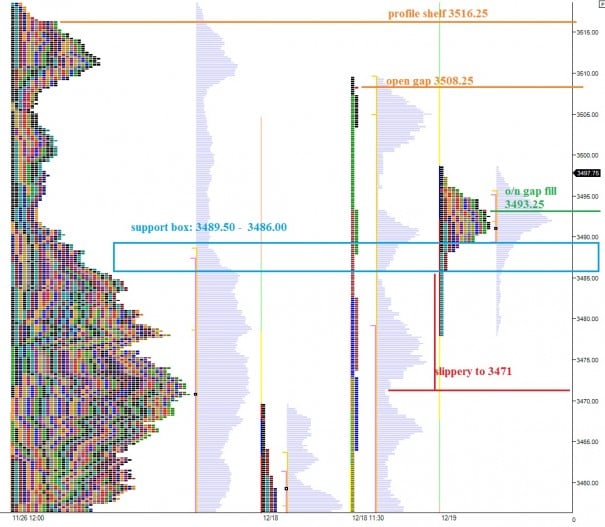

Talking overnight gaps, we still have a gap open between Wednesday and Thusday on the upside at 3508.25 and we have this morning’s gap down to 3493.25. These contextual pieces may lend themselves to a bit of chop in the early market hours.

Yesterday was a digestion/balancing day, with the market accepting it’s marked up prices and buyers on the delta. Buyers on the delta refers to the order flow intraday, where we saw participants willing to take the offer and actively engage the market to enter long positions (or cover shorts). We printed the very uncommon normal day in market profile terminology, where the first hour’s price action was very wide and contained the range for the rest of the day. We have a buying tail on the low end of our profile suggesting buyers perceived the early drop in prices as deep discount and reacted accordingly.

Overall, we printed a P-shaped profile which signals a short squeeze occurred. Whether that squeeze will provide the tinder to spark another rally will be revealed today by the auction activity.

I have highlighted levels I will be watching to track the progress made by buyers and sellers on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter