The equity markets opened Sunday evening only to find buyers interested in increased exposure. Since then price has behaved orderly, consolidating the overnight gains and positioning price outside of Friday’s price range and value.

Should prices on the NASDAQ composite sustain trade over 3511 into the opening bell, we are opening out of balance, and the risk of a violent move is high. However, if I have correctly identified where were are currently trading within the sentiment cycle, we are deep in denial, which may produce muted trade.

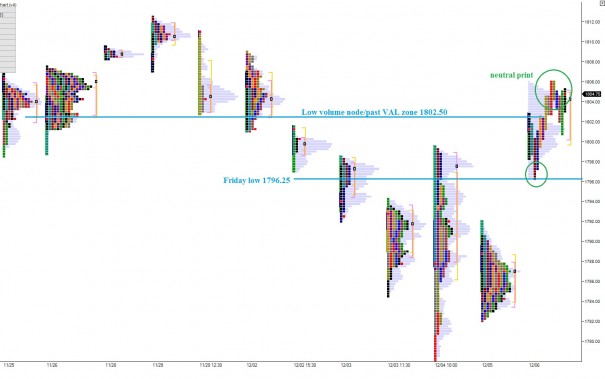

The S&P is currently trading only two handles above Friday’s closing price which leaves the door open for a gap fill lower. Early on, perhaps even pre-market, we may see sellers coming in to close the gap. More important contextually than the gap however, is the low volume node we printed on Friday’s S&P volume profile at 1802.50. This price level set value area low several times in November and on Friday the action from buyers was dynamic enough to leave a low volume, fast moving footprint. Should the sellers quickly reject us back below this level and sustain trade for over an hour, we may be in store for further downside.

The NASDAQ is currently trading eight handles above its closing print showing greater strength early on. I will be watching the overnight swing low at 3506.75 to measure bullish appetite early on.

Overall, the action looks ripe for a rally however it is paramount we stay objective in our analysis and accept and define price levels which may negate our thesis. I have highlighted the low volume zone on the S&P on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter