Markets are ripping higher overnight, pressing the /ES nearly to the top of the gap left behind on 08/15. By the looks of the overnight tape many buy stop orders we triggered and a stop run ensued. The question now is, will the buy flow continue to push the market higher, or will we see a big selling reaction to a perceived premium in the marketplace?

The S&P is currently trading ten handles above yesterday’s high, and nearly twelve handles above the closing print. Therefore we are in pro gap territory where it is very difficult to play a gap fill trade. However, we should keep the context of the gap fill trade in mind today if we see sellers start to recapture areas of support.

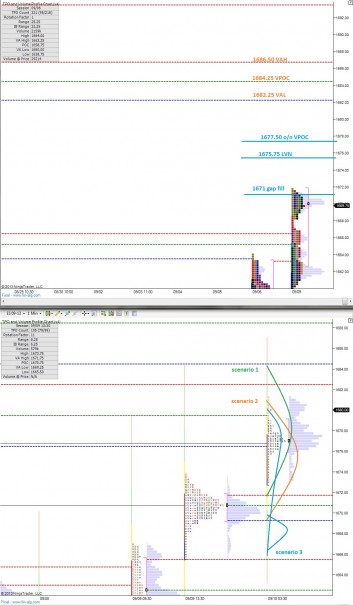

An interesting zone of price overnight is from 1674.50 – 1675.75 where price moved so fast, nearly no volume took place. Price could revisit this area and give it a proper auction. Should this occur, the subsequent move from the zone may give us some insight into who is more active today, the buyers or the sellers.

Given the distance the market covered overnight, my intial expectation as we approach the cash open is to see selling enter the market. Initial downside targets are 1677.50 then 1675.75 and a possible gap fill to 1671. On the upside, we have the lowest distribution from when we gapped lower with resistance at 1682.25 (VAL), 1684.25 (VPOC), then 1686.50 (VAH).

I’ve highlighted these levels and drawn out a few scenarios on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter