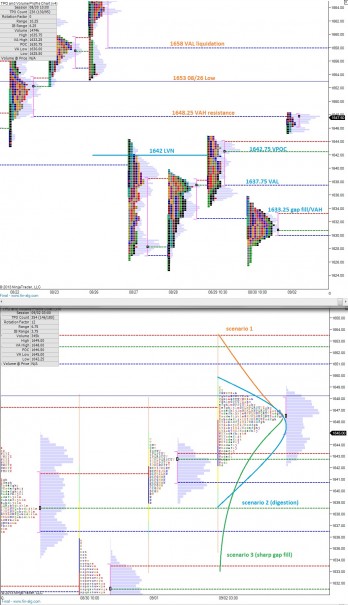

The big gap higher over the long weekend is still mostly intact on the S&P 500 as we approach the cash open. Early this morning a bit of selling entered the market and took us off the overnight highs by a few handles but the market has mostly digested the move, holding above the 08/29 VPOC at 1642.75.

Last Thursday (08/29) featured a poor high which can be seen on the RTH market profile as several TPOs stacked at the top without a single print TPO. These types of highs are often resolved sooner rather than later and it was an excellent clue we may see some relief strength in the index.

The question today is which of the three scenarios drawn out below come into play today. The important level to keep in mind for scenario 1 to occur is the aforementioned 1642.75 VPOC. Should price sustain trade below this level for more than an hour it could signal acceptance of the lower value which often results in rotation back through the value. That would print either a scenario 2 or 3.

I’ve noted some levels of resistance the market needs to clear in order to print scenario 1. Most important however is recapturing the zone covering the overnight high at 1649 and 1648.25 which would put the market back into the 08/22 value zone from two weeks back. The market accepting trade (sustaining trade for more than an hour) within this value area opens the door to a larger upward move, perhaps even triggering a short squeeze to 1674.50. That would be the bulls crowning achievement if they’re able to accomplish it this week.

I’ve noted these price levels and the three scenarios on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter

Firmly positioned in scenario 2 at the momement

thx raul